Form 21826 - Sales And Use Tax Requirements

ADVERTISEMENT

North Dakota

Office of State Tax Commissioner

S

U

T

R

ALES AND

SE

AX

EQUIREMENTS

R

C

ICK

LAYBURGH

T

C

AX

OMMISSIONER

Sales and Use Tax Guideline

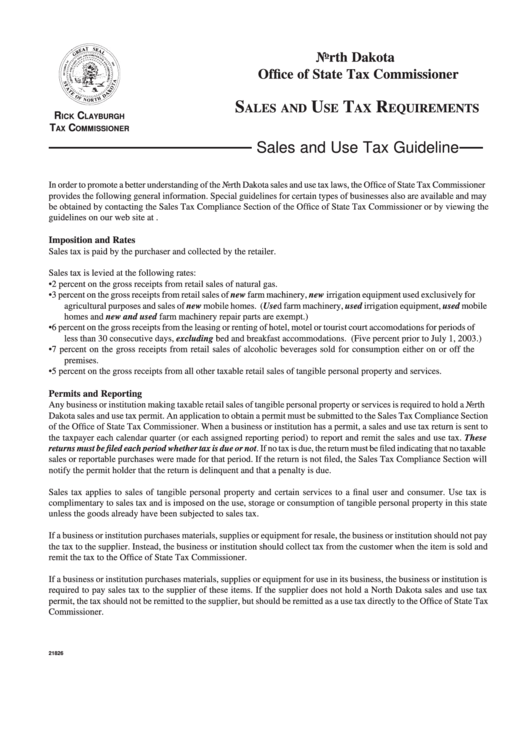

In order to promote a better understanding of the North Dakota sales and use tax laws, the Office of State Tax Commissioner

provides the following general information. Special guidelines for certain types of businesses also are available and may

be obtained by contacting the Sales Tax Compliance Section of the Office of State Tax Commissioner or by viewing the

guidelines on our web site at

Imposition and Rates

Sales tax is paid by the purchaser and collected by the retailer.

Sales tax is levied at the following rates:

•

2 percent on the gross receipts from retail sales of natural gas.

•

3 percent on the gross receipts from retail sales of new farm machinery, new irrigation equipment used exclusively for

agricultural purposes and sales of new mobile homes. (Used farm machinery, used irrigation equipment, used mobile

homes and new and used farm machinery repair parts are exempt.)

•

6 percent on the gross receipts from the leasing or renting of hotel, motel or tourist court accomodations for periods of

less than 30 consecutive days, excluding bed and breakfast accommodations. (Five percent prior to July 1, 2003.)

•

7 percent on the gross receipts from retail sales of alcoholic beverages sold for consumption either on or off the

premises.

•

5 percent on the gross receipts from all other taxable retail sales of tangible personal property and services.

Permits and Reporting

Any business or institution making taxable retail sales of tangible personal property or services is required to hold a North

Dakota sales and use tax permit. An application to obtain a permit must be submitted to the Sales Tax Compliance Section

of the Office of State Tax Commissioner. When a business or institution has a permit, a sales and use tax return is sent to

the taxpayer each calendar quarter (or each assigned reporting period) to report and remit the sales and use tax. These

returns must be filed each period whether tax is due or not. If no tax is due, the return must be filed indicating that no taxable

sales or reportable purchases were made for that period. If the return is not filed, the Sales Tax Compliance Section will

notify the permit holder that the return is delinquent and that a penalty is due.

Sales tax applies to sales of tangible personal property and certain services to a final user and consumer. Use tax is

complimentary to sales tax and is imposed on the use, storage or consumption of tangible personal property in this state

unless the goods already have been subjected to sales tax.

If a business or institution purchases materials, supplies or equipment for resale, the business or institution should not pay

the tax to the supplier. Instead, the business or institution should collect tax from the customer when the item is sold and

remit the tax to the Office of State Tax Commissioner.

If a business or institution purchases materials, supplies or equipment for use in its business, the business or institution is

required to pay sales tax to the supplier of these items. If the supplier does not hold a North Dakota sales and use tax

permit, the tax should not be remitted to the supplier, but should be remitted as a use tax directly to the Office of State Tax

Commissioner.

21826

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4