Form W-1 - Return Of Income Tax Withheld - Village Of Octa Income Tax, Ohio

ADVERTISEMENT

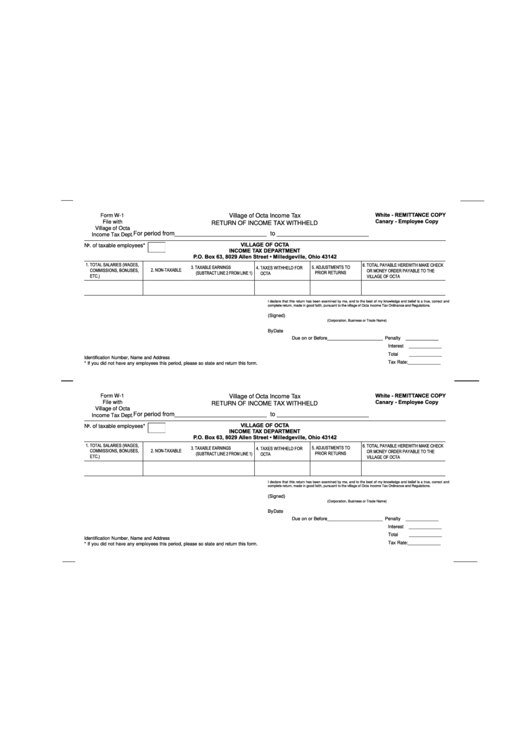

White - REMITTANCE COPY

Form W-1

Village of Octa Income Tax

Canary - Employee Copy

File with

RETURN OF INCOME TAX WITHHELD

Village of Octa

For period from ___________________________ to ___________________________

Income Tax Dept.

VILLAGE OF OCTA

No. of taxable employees*

INCOME TAX DEPARTMENT

P.O. Box 63, 8029 Allen Street • Milledgeville, Ohio 43142

1. TOTAL SALARIES (WAGES,

6. TOTAL PAYABLE HEREWITH MAKE CHECK

3. TAXABLE EARNINGS

5. ADJUSTMENTS TO

4. TAXES WITHHELD FOR

2. NON-TAXABLE

COMMISSIONS, BONUSES,

OR MONEY ORDER PAYABLE TO THE

(SUBTRACT LINE 2 FROM LINE 1)

PRIOR RETURNS

OCTA

ETC.)

VILLAGE OF OCTA

I declare that this return has been examined by me, and to the best of my knowledge and belief is a true, correct and

complete return, made in good faith, pursuant to the village of Octa Income Tax Ordinance and Regulations.

(Signed) ..........................................................................................................................

(Corporation, Business or Trade Name)

By .............................................................................. Date ............................................

Due on or Before ______________________ Penalty

_____________

Interest

_____________

Total

_____________

Identification Number, Name and Address

Tax Rate: _____________

* If you did not have any employees this period, please so state and return this form.

White - REMITTANCE COPY

Form W-1

Village of Octa Income Tax

Canary - Employee Copy

File with

RETURN OF INCOME TAX WITHHELD

Village of Octa

For period from ___________________________ to ___________________________

Income Tax Dept.

VILLAGE OF OCTA

No. of taxable employees*

INCOME TAX DEPARTMENT

P.O. Box 63, 8029 Allen Street • Milledgeville, Ohio 43142

1. TOTAL SALARIES (WAGES,

6. TOTAL PAYABLE HEREWITH MAKE CHECK

3. TAXABLE EARNINGS

5. ADJUSTMENTS TO

4. TAXES WITHHELD FOR

2. NON-TAXABLE

COMMISSIONS, BONUSES,

OR MONEY ORDER PAYABLE TO THE

(SUBTRACT LINE 2 FROM LINE 1)

PRIOR RETURNS

OCTA

ETC.)

VILLAGE OF OCTA

I declare that this return has been examined by me, and to the best of my knowledge and belief is a true, correct and

complete return, made in good faith, pursuant to the village of Octa Income Tax Ordinance and Regulations.

(Signed) ..........................................................................................................................

(Corporation, Business or Trade Name)

By .............................................................................. Date ............................................

Due on or Before ______________________ Penalty

_____________

Interest

_____________

Total

_____________

Identification Number, Name and Address

Tax Rate: _____________

* If you did not have any employees this period, please so state and return this form.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1