Form It-140x Instruction For Amended West Virginia Personal Income Tax Return

ADVERTISEMENT

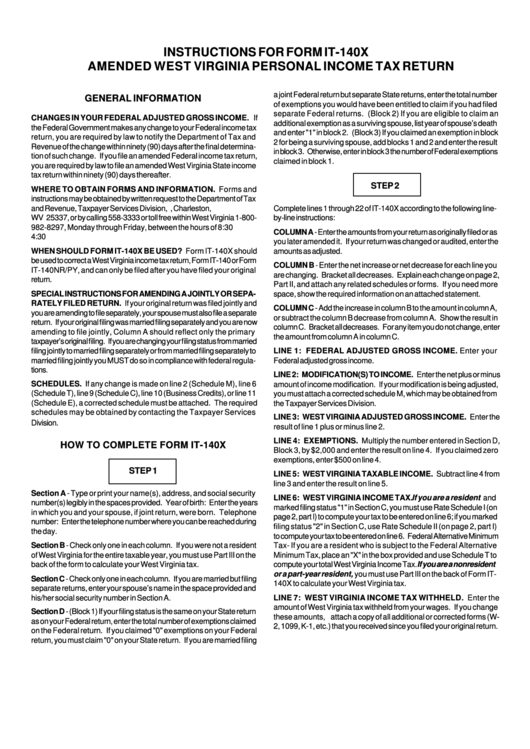

INSTRUCTIONS FOR FORM IT-140X

AMENDED WEST VIRGINIA PERSONAL INCOME TAX RETURN

a joint Federal return but separate State returns, enter the total number

GENERAL INFORMATION

of exemptions you would have been entitled to claim if you had filed

separate Federal returns. (Block 2) If you are eligible to claim an

CHANGES IN YOUR FEDERAL ADJUSTED GROSS INCOME. If

additional exemption as a surviving spouse, list year of spouse’s death

the Federal Government makes any change to your Federal income tax

and enter "1" in block 2. (Block 3) If you claimed an exemption in block

return, you are required by law to notify the Department of Tax and

2 for being a surviving spouse, add blocks 1 and 2 and enter the result

Revenue of the change within ninety (90) days after the final determina-

in block 3. Otherwise, enter in block 3 the number of Federal exemptions

tion of such change. If you file an amended Federal income tax return,

claimed in block 1.

you are required by law to file an amended West Virginia State income

tax return within ninety (90) days thereafter.

STEP 2

WHERE TO OBTAIN FORMS AND INFORMATION. Forms and

instructions may be obtained by written request to the Department of Tax

and Revenue, Taxpayer Services Division, P.O. Box 3784, Charleston,

Complete lines 1 through 22 of IT-140X according to the following line-

WV 25337, or by calling 558-3333 or toll free within West Virginia 1-800-

by-line instructions:

982-8297, Monday through Friday, between the hours of 8:30 a.m. to

COLUMN A - Enter the amounts from your return as originally filed or as

4:30 p.m.

you later amended it. If your return was changed or audited, enter the

WHEN SHOULD FORM IT-140X BE USED? Form IT-140X should

amounts as adjusted.

be used to correct a West Virginia income tax return, Form IT-140 or Form

COLUMN B - Enter the net increase or net decrease for each line you

IT-140NR/PY, and can only be filed after you have filed your original

are changing. Bracket all decreases. Explain each change on page 2,

return.

Part II, and attach any related schedules or forms. If you need more

SPECIAL INSTRUCTIONS FOR AMENDING A JOINTLY OR SEPA-

space, show the required information on an attached statement.

RATELY FILED RETURN. If your original return was filed jointly and

COLUMN C - Add the increase in column B to the amount in column A,

you are amending to file separately, your spouse must also file a separate

or subtract the column B decrease from column A. Show the result in

return. If your original filing was married filing separately and you are now

column C. Bracket all decreases. For any item you do not change, enter

amending to file jointly, Column A should reflect only the primary

the amount from column A in column C.

taxpayer’s original filing. If you are changing your filing status from married

filing jointly to married filing separately or from married filing separately to

LINE 1: FEDERAL ADJUSTED GROSS INCOME. Enter your

married filing jointly you MUST do so in compliance with federal regula-

Federal adjusted gross income.

tions.

LINE 2: MODIFICATION(S) TO INCOME. Enter the net plus or minus

SCHEDULES. If any change is made on line 2 (Schedule M), line 6

amount of income modification. If your modification is being adjusted,

(Schedule T), line 9 (Schedule C), line 10 (Business Credits), or line 11

you must attach a corrected schedule M, which may be obtained from

(Schedule E), a corrected schedule must be attached. The required

the Taxpayer Services Division.

schedules may be obtained by contacting the Taxpayer Services

LINE 3: WEST VIRGINIA ADJUSTED GROSS INCOME. Enter the

Division.

result of line 1 plus or minus line 2.

LINE 4: EXEMPTIONS. Multiply the number entered in Section D,

HOW TO COMPLETE FORM IT-140X

Block 3, by $2,000 and enter the result on line 4. If you claimed zero

exemptions, enter $500 on line 4.

STEP 1

LINE 5: WEST VIRGINIA TAXABLE INCOME. Subtract line 4 from

line 3 and enter the result on line 5.

Section A - Type or print your name(s), address, and social security

LINE 6: WEST VIRGINIA INCOME TAX. If you are a resident and

number(s) legibly in the spaces provided. Year of birth: Enter the years

marked filing status "1" in Section C, you must use Rate Schedule I (on

in which you and your spouse, if joint return, were born. Telephone

page 2, part I) to compute your tax to be entered on line 6; if you marked

number: Enter the telephone number where you can be reached during

filing status "2" in Section C, use Rate Schedule II (on page 2, part I)

the day.

to compute your tax to be entered on line 6. Federal Alternative Minimum

Section B - Check only one in each column. If you were not a resident

Tax- If you are a resident who is subject to the Federal Alternative

of West Virginia for the entire taxable year, you must use Part III on the

Minimum Tax, place an "X" in the box provided and use Schedule T to

back of the form to calculate your West Virginia tax.

compute your total West Virginia Income Tax. If you are a nonresident

or a part-year resident, you must use Part III on the back of Form IT-

Section C - Check only one in each column. If you are married but filing

140X to calculate your West Virginia tax.

separate returns, enter your spouse’s name in the space provided and

his/her social security number in Section A.

LINE 7: WEST VIRGINIA INCOME TAX WITHHELD. Enter the

amount of West Virginia tax withheld from your wages. If you change

Section D - (Block 1) If your filing status is the same on your State return

these amounts, attach a copy of all additional or corrected forms (W-

as on your Federal return, enter the total number of exemptions claimed

2, 1099, K-1, etc.) that you received since you filed your original return.

on the Federal return. If you claimed "0" exemptions on your Federal

return, you must claim "0" on your State return. If you are married filing

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2