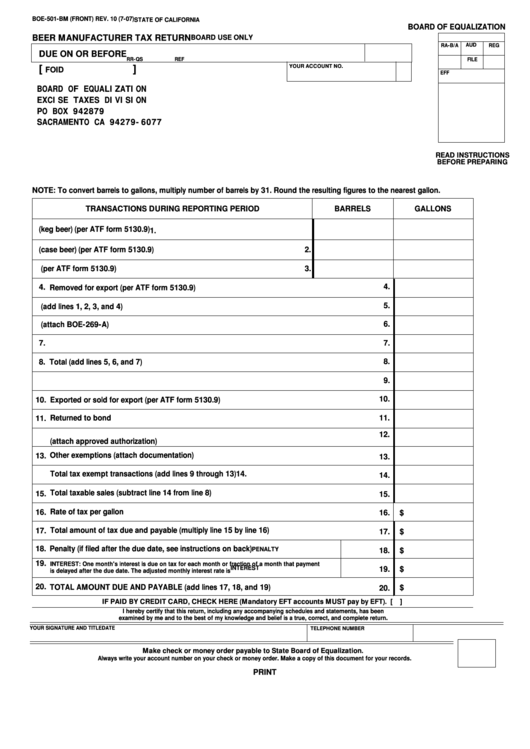

BOE-501-BM (FRONT) REV. 10 (7-07)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

BEER MANUFACTURER TAX RETURN

BOARD USE ONLY

RA-B/A

AUD

REG

DUE ON OR BEFORE

RR-QS

REF

FILE

YOUR ACCOUNT NO.

[

]

FOID

EFF

BOARD OF EQUALIZATION

EXCISE TAXES DIVISION

PO BOX 942879

SACRAMENTO CA 94279-6077

READ INSTRUCTIONS

BEFORE PREPARING

NOTE: To convert barrels to gallons, multiply number of barrels by 31. Round the resulting figures to the nearest gallon.

TRANSACTIONS DURING REPORTING PERIOD

BARRELS

GALLONS

1. Removed tax-paid (keg beer) (per ATF form 5130.9)

1.

2.

2. Removed tax-paid (case beer) (per ATF form 5130.9)

3.

3. Removed for use at tavern on brewery premises (per ATF form 5130.9)

4. Removed for export (per ATF form 5130.9)

4.

5.

5. Total removals (add lines 1, 2, 3, and 4)

6.

6. Imported into California (attach BOE-269-A)

7.

7.

8. Total (add lines 5, 6, and 7)

8.

9.

9. Imported in or bulk transfers to U.S. Internal Revenue bond

10.

10.

Exported or sold for export (per ATF form 5130.9)

11.

Returned to bond

11.

12. Federal tax-paid beer destroyed under the supervision of a Board representative

12.

(attach approved authorization)

13. Other exemptions (attach documentation)

13.

14.

Total tax exempt transactions (add lines 9 through 13)

14.

Total taxable sales (subtract line 14 from line 8)

15.

15.

Rate of tax per gallon

16.

16.

$

Total amount of tax due and payable (multiply line 15 by line 16)

17.

17.

$

18. Penalty (if filed after the due date, see instructions on back)

PENALTY

18.

$

19.

INTEREST: One month's interest is due on tax for each month or fraction of a month that payment

INTEREST

19.

$

is delayed after the due date. The adjusted monthly interest rate is

20. TOTAL AMOUNT DUE AND PAYABLE (add lines 17, 18, and 19)

20.

$

IF PAID BY CREDIT CARD, CHECK HERE (Mandatory EFT accounts MUST pay by EFT). [

]

I hereby certify that this return, including any accompanying schedules and statements, has been

examined by me and to the best of my knowledge and belief is a true, correct, and complete return.

YOUR SIGNATURE AND TITLE

DATE

TELEPHONE NUMBER

Make check or money order payable to State Board of Equalization.

Always write your account number on your check or money order. Make a copy of this document for your records.

CLEAR

PRINT

1

1 2

2