Form Ador 74-4028 - Application For Registration To Sell Tobacco Products Form- For Distributors Of Tobacco Products - Arizona Department Of Revenue

ADVERTISEMENT

Arizona Department of Revenue

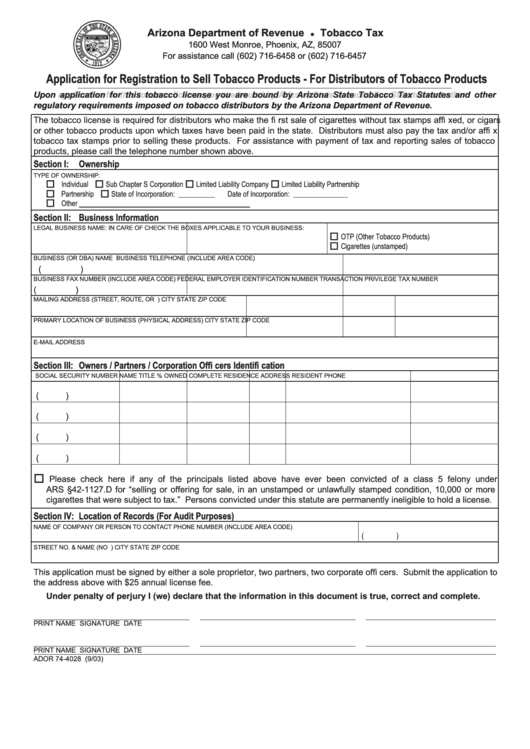

Arizona Department of Revenue • • Tobacco Tax

Tobacco Tax

1600 West Monroe, Phoenix, AZ, 85007

1600 West Monroe, Phoenix, AZ, 85007

For assistance call (602) 716-6458 or (602) 716-6457

For assistance call (602) 716-6458 or (602) 716-6457

Application for Registration to Sell Tobacco Products - For Distributors of Tobacco Products

Application for Registration to Sell Tobacco Products - For Distributors of Tobacco Products

Upon application for this tobacco license you are bound by Arizona State Tobacco Tax Statutes and other

Upon application for this tobacco license you are bound by Arizona State Tobacco Tax Statutes and other

regulatory requirements imposed on tobacco distributors by the Arizona Department of Revenue.

regulatory requirements imposed on tobacco distributors by the Arizona Department of Revenue.

The tobacco license is required for distributors who make the fi rst sale of cigarettes without tax stamps affi xed, or cigars

or other tobacco products upon which taxes have been paid in the state. Distributors must also pay the tax and/or affi x

tobacco tax stamps prior to selling these products. For assistance with payment of tax and reporting sales of tobacco

products, please call the telephone number shown above.

Section I:

Section I:

Ownership

Ownership

TYPE OF OWNERSHIP:

Individual

Sub Chapter S Corporation

Limited Liability Company

Limited Liability Partnership

Partnership

State of Incorporation: __________

Date of Incorporation: _______________

Other

Section II:

Section II: Business Information

Business Information

LEGAL BUSINESS NAME:

IN CARE OF

CHECK THE BOXES APPLICABLE TO YOUR BUSINESS:

OTP (Other Tobacco Products)

Cigarettes (unstamped)

BUSINESS (OR DBA) NAME

BUSINESS TELEPHONE (INCLUDE AREA CODE)

(

)

BUSINESS FAX NUMBER (INCLUDE AREA CODE)

FEDERAL EMPLOYER IDENTIFICATION NUMBER

TRANSACTION PRIVILEGE TAX NUMBER

(

)

MAILING ADDRESS (STREET, ROUTE, OR P.O. BOX)

CITY

STATE

ZIP CODE

PRIMARY LOCATION OF BUSINESS (PHYSICAL ADDRESS)

CITY

STATE

ZIP CODE

E-MAIL ADDRESS

Section III:

Section III: Owners / Partners / Corporation Offi cers Identifi cation

Owners / Partners / Corporation Offi cers Identifi cation

SOCIAL SECURITY NUMBER

NAME

TITLE

% OWNED

COMPLETE RESIDENCE ADDRESS

RESIDENT PHONE

(

)

(

)

(

)

(

)

Please check here if any of the principals listed above have ever been convicted of a class 5 felony under

ARS §42-1127.D for “selling or offering for sale, in an unstamped or unlawfully stamped condition, 10,000 or more

cigarettes that were subject to tax.” Persons convicted under this statute are permanently ineligible to hold a license.

Section IV:

Section IV: Location of Records (For Audit Purposes)

Location of Records (For Audit Purposes)

NAME OF COMPANY OR PERSON TO CONTACT

PHONE NUMBER (INCLUDE AREA CODE)

(

)

STREET NO. & NAME (NO P.O. BOX OR RT. NO.)

CITY

STATE

ZIP CODE

This application must be signed by either a sole proprietor, two partners, two corporate offi cers. Submit the application to

the address above with $25 annual license fee.

Under penalty of perjury I (we) declare that the information in this document is true, correct and complete.

PRINT NAME

SIGNATURE

DATE

PRINT NAME

SIGNATURE

DATE

ADOR 74-4028 (9/03)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2