Form Does-Uc30 - Employer'S Quarterly Contribution And Wage Report Form Page 2

ADVERTISEMENT

W W

W

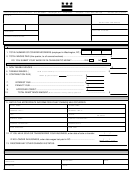

Government of the District of Columbia

Department of Employment Services

Office of Unemployment Compensation P.O. Box 96664 Washington, D.C. 20090-6664 Telephone: Local: (202) 698-7550 Toll Free: (877) 319-7346

FORM ID:

POSTMARK DATE

EMPLOYER'S QUARTERLY CONTRIBUTION AND

DOES-UC30

WAGE REPORT

EMPLOYER NUMBER:

NAME CHK:

(DO NOT USE THIS SPACE)

FEDERAL IDENTIFICATION NUMBER:

TAX RATE:

QUARTER ENDING:

TAXABLE WAGE BASE:

THIS REPORT DUE:

9000.00

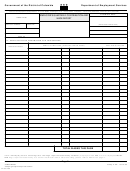

13. EMPLOYEE WAGE INFORMATION FOR THIS QUARTER

TOTAL GROSS WAGES

NAME OF EMPLOYEE (PLEASE TYPE OR PRINT)

PAID THIS QUARTER

EMPLOYEE'S SSN

FIRST NAME

INITIAL

LAST NAME

DOLLARS

CENTS

TOTAL WAGES THIS PAGE

NOTE: All Employers are encouraged to file wage reports electronically. However, employers with 250 or more employees MUST

FILE wage reports electronically. For further information about electronic filing, please refer to PART 2 on page 4.

Page 2

JOB SERVICE

uc30p 2.frm rev 12/05

"Helping People Help Themselves"

5Z1036 4.000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2