Participation Form For The Flexible Benefits Plan

ADVERTISEMENT

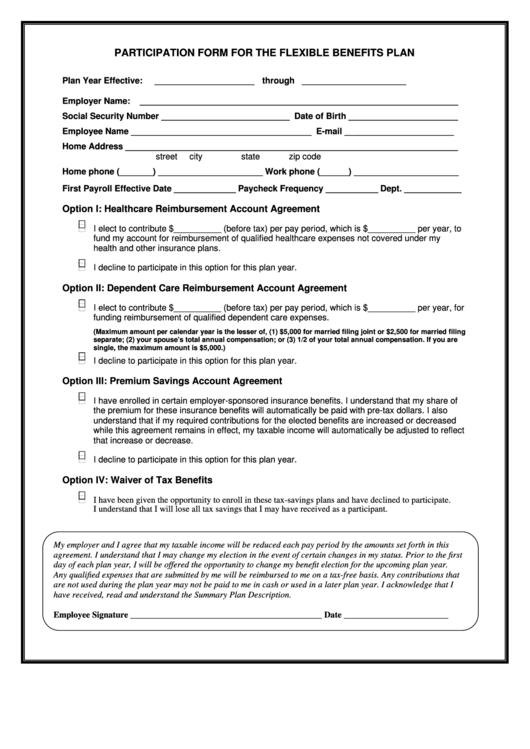

PARTICIPATION FORM FOR THE FLEXIBLE BENEFITS PLAN

Plan Year Effective:

_____________________ through ______________________

Employer Name:

___________________________________________________________________

Social Security Number ___________________________ Date of Birth _______________________

Employee Name ______________________________________ E-mail _______________________

Home Address ______________________________________________________________________

street

city

state

zip code

Home phone (_______) ______________________ Work phone (______) ______________________

First Payroll Effective Date _____________ Paycheck Frequency ___________ Dept. ____________

Option I: Healthcare Reimbursement Account Agreement

I elect to contribute $__________ (before tax) per pay period, which is $__________ per year, to

fund my account for reimbursement of qualified healthcare expenses not covered under my

health and other insurance plans.

I decline to participate in this option for this plan year.

Option II: Dependent Care Reimbursement Account Agreement

I elect to contribute $__________ (before tax) per pay period, which is $__________ per year, for

funding reimbursement of qualified dependent care expenses.

(Maximum amount per calendar year is the lesser of, (1) $5,000 for married filing joint or $2,500 for married filing

separate; (2) your spouse’s total annual compensation; or (3) 1/2 of your total annual compensation. If you are

single, the maximum amount is $5,000.)

I decline to participate in this option for this plan year.

Option III: Premium Savings Account Agreement

I have enrolled in certain employer-sponsored insurance benefits. I understand that my share of

the premium for these insurance benefits will automatically be paid with pre-tax dollars. I also

understand that if my required contributions for the elected benefits are increased or decreased

while this agreement remains in effect, my taxable income will automatically be adjusted to reflect

that increase or decrease.

I decline to participate in this option for this plan year.

Option IV: Waiver of Tax Benefits

I have been given the opportunity to enroll in these tax-savings plans and have declined to participate.

I understand that I will lose all tax savings that I may have received as a participant.

My employer and I agree that my taxable income will be reduced each pay period by the amounts set forth in this

agreement. I understand that I may change my election in the event of certain changes in my status. Prior to the first

day of each plan year, I will be offered the opportunity to change my benefit election for the upcoming plan year.

Any qualified expenses that are submitted by me will be reimbursed to me on a tax-free basis. Any contributions that

are not used during the plan year may not be paid to me in cash or used in a later plan year. I acknowledge that I

have received, read and understand the Summary Plan Description.

Employee Signature ____________________________________________ Date ________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1