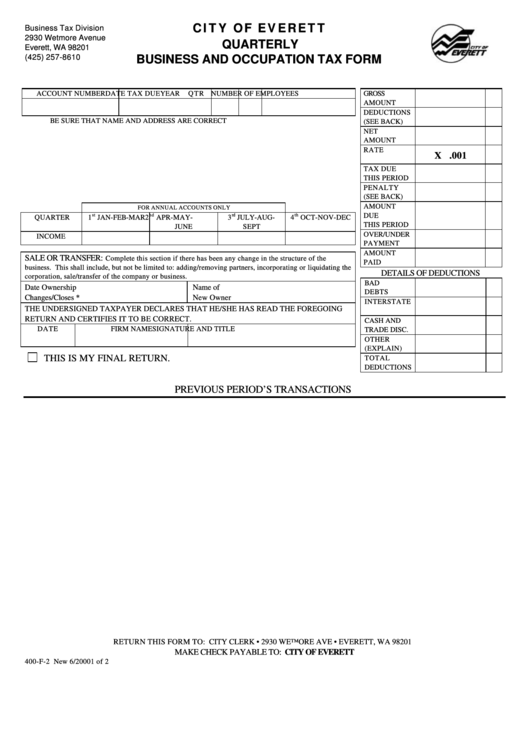

Form 400-F-2 - Quarterly Business And Occupation Tax Form

ADVERTISEMENT

CITY OF EVERETT

Business Tax Division

2930 Wetmore Avenue

QUARTERLY

Everett, WA 98201

(425) 257-8610

BUSINESS AND OCCUPATION TAX FORM

ACCOUNT NUMBER

DATE TAX DUE

YEAR

QTR NUMBER OF EMPLOYEES

GROSS

AMOUNT

DEDUCTIONS

BE SURE THAT NAME AND ADDRESS ARE CORRECT

(SEE BACK)

NET

AMOUNT

RATE

X .001

TAX DUE

THIS PERIOD

PENALTY

(SEE BACK)

AMOUNT

FOR ANNUAL ACCOUNTS ONLY

DUE

st

nd

rd

th

QUARTER

1

JAN-FEB-MAR

2

APR-MAY-

3

JULY-AUG-

4

OCT-NOV-DEC

THIS PERIOD

JUNE

SEPT

OVER/UNDER

INCOME

PAYMENT

AMOUNT

SALE OR TRANSFER:

Complete this section if there has been any change in the structure of the

PAID

business. This shall include, but not be limited to: adding/removing partners, incorporating or liquidating the

DETAILS OF DEDUCTIONS

corporation, sale/transfer of the company or business.

BAD

Date Ownership

Name of

DEBTS

Changes/Closes *

New Owner

INTERSTATE

THE UNDERSIGNED TAXPAYER DECLARES THAT HE/SHE HAS READ THE FOREGOING

RETURN AND CERTIFIES IT TO BE CORRECT.

CASH AND

DATE

FIRM NAME

SIGNATURE AND TITLE

TRADE DISC.

OTHER

(EXPLAIN)

THIS IS MY FINAL RETURN.

TOTAL

DEDUCTIONS

PREVIOUS PERIOD’S TRANSACTIONS

RETURN THIS FORM TO: CITY CLERK • 2930 WETMORE AVE • EVERETT, WA 98201

MAKE CHECK PAYABLE TO: CITY OF EVERETT

400-F-2 New 6/2000

1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1