Consolidated Sales & Use Tax Report Form For Morehouse Parish, La

ADVERTISEMENT

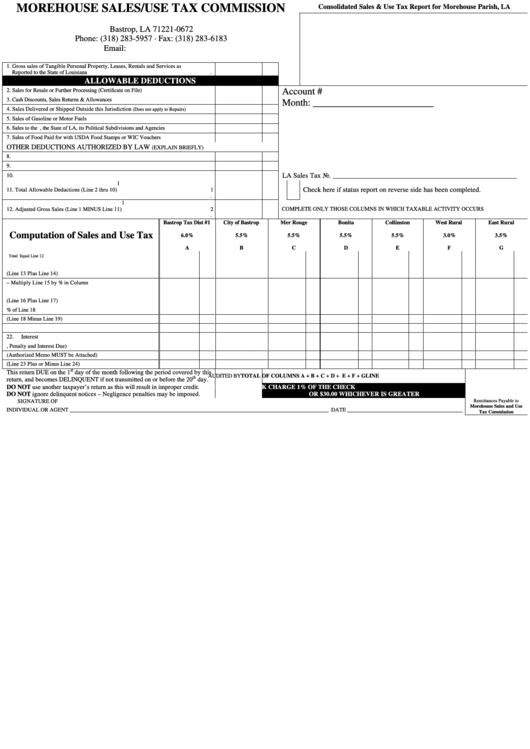

MOREHOUSE SALES/USE TAX COMMISSION

Consolidated Sales & Use Tax Report for Morehouse Parish, LA

P.O. Box 672

Bastrop, LA 71221-0672

Phone: (318) 283-5957 · Fax: (318) 283-6183

Email: mpstc@bellsouth.net

1. Gross sales of Tangible Personal Property, Leases, Rentals and Services as

1

Reported to the State of Louisiana

.

ALLOWABLE DEDUCTIONS

OFFICE USE ONLY

Account #

2. Sales for Resale or Further Processing (Certificate on File)

3. Cash Discounts, Sales Returns & Allowances

Month: _________________________

4. Sales Delivered or Shipped Outside this Jurisdiction

(Does not apply to Repairs)

5. Sales of Gasoline or Motor Fuels

6. Sales to the U.S. Govt., the State of LA, its Political Subdivisions and Agencies

7. Sales of Food Paid for with USDA Food Stamps or WIC Vouchers

OTHER DEDUCTIONS AUTHORIZED BY LAW

(EXPLAIN BRIEFLY)

8.

9.

LA Sales Tax No. ____________________________________________________

10.

1

Check here if status report on reverse side has been completed.

11. Total Allowable Deductions (Line 2 thru 10)

1

.

1

12. Adjusted Gross Sales (Line 1 MINUS Line 11)

2

COMPLETE ONLY THOSE COLUMNS IN WHICH TAXABLE ACTIVITY OCCURS

.

Bastrop Tax Dist #1

City of Bastrop

Mer Rouge

Bonita

Collinston

West Rural

East Rural

Computation of Sales and Use Tax

6.0%

5.5%

5.5%

5.5%

5.5%

3.0%

3.5%

A

B

C

D

E

F

G

13.

Adjusted Gross Sales in Each Jurisdiction

Total Equal Line 12

14.

Purchases Subject to Use Tax In Each Jurisdiction

15.

TOTAL (Line 13 Plus Line 14)

16.

Tax Due – Multiply Line 15 by % in Column

17.

Excess Tax Collected

18.

TOTAL (Line 16 Plus Line 17)

19.

Vendors Compensation 1.1% of Line 18

20.

Net Tax Due (Line 18 Minus Line 19)

21.

Delinquent Penalty

22.

Interest

23.

Total Tax, Penalty and Interest Due)

24.

Tax Debit or Credit (Authorized Memo MUST be Attached)

25.

TOTAL AMOUNT DUE (Line 23 Plus or Minus Line 24)

st

This return DUE on the 1

day of the month following the period covered by this

AUDITED BY

TOTAL OF COLUMNS A + B + C + D + E + F + G

LINE 26.

TOTAL REMITTED

th

return, and becomes DELINQUENT if not transmitted on or before the 20

day.

DO NOT use another taxpayer’s return as this will result in improper credit.

DISHONORED CHECK CHARGE 1% OF THE CHECK

$

DO NOT ignore delinquent notices – Negligence penalties may be imposed.

OR $30.00 WHICHEVER IS GREATER

SIGNATURE OF

Remittances Payable to

Morehouse Sales and Use

INDIVIDUAL OR AGENT _____________________________________________________________________________________________ DATE _________________________________________

Tax Commission

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2