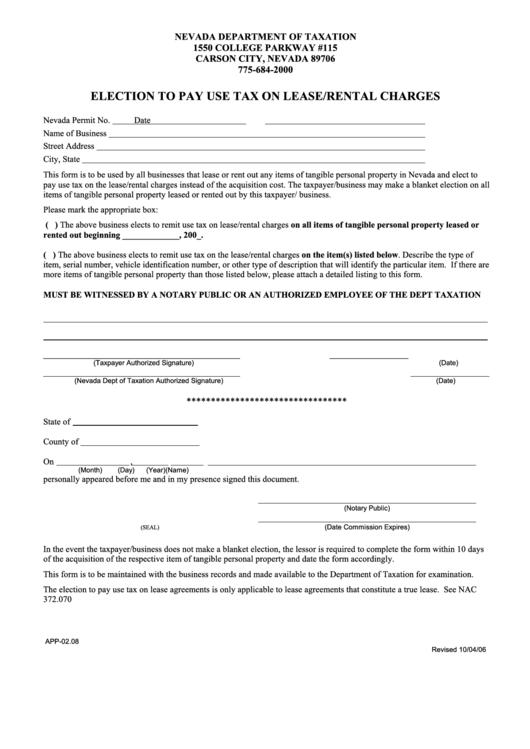

Election To Pay Use Tax On Lease/rental Charges Form - 2006

ADVERTISEMENT

NEVADA DEPARTMENT OF TAXATION

1550 COLLEGE PARKWAY #115

CARSON CITY, NEVADA 89706

775-684-2000

ELECTION TO PAY USE TAX ON LEASE/RENTAL CHARGES

Nevada Permit No.

Date

Name of Business

Street Address

City, State

This form is to be used by all businesses that lease or rent out any items of tangible personal property in Nevada and elect to

pay use tax on the lease/rental charges instead of the acquisition cost. The taxpayer/business may make a blanket election on all

items of tangible personal property leased or rented out by this taxpayer/ business.

Please mark the appropriate box:

( ) The above business elects to remit use tax on lease/rental charges on all items of tangible personal property leased or

rented out beginning _____________, 200_.

( ) The above business elects to remit use tax on the lease/rental charges on the item(s) listed below. Describe the type of

item, serial number, vehicle identification number, or other type of description that will identify the particular item. If there are

more items of tangible personal property than those listed below, please attach a detailed listing to this form.

MUST BE WITNESSED BY A NOTARY PUBLIC OR AN AUTHORIZED EMPLOYEE OF THE DEPT TAXATION

_____________________________________________

__________________

(Taxpayer Authorized Signature)

(Date)

_____________________________________________

__________________

(Nevada Dept of Taxation Authorized Signature)

(Date)

*********************************

State of

County of

On

,

(Month)

(Day)

(Year)

(Name)

personally appeared before me and in my presence signed this document.

(Notary Public)

(Date Commission Expires)

(SEAL)

In the event the taxpayer/business does not make a blanket election, the lessor is required to complete the form within 10 days

of the acquisition of the respective item of tangible personal property and date the form accordingly.

This form is to be maintained with the business records and made available to the Department of Taxation for examination.

The election to pay use tax on lease agreements is only applicable to lease agreements that constitute a true lease. See NAC

372.070

APP-02.08

Revised 10/04/06

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1