K

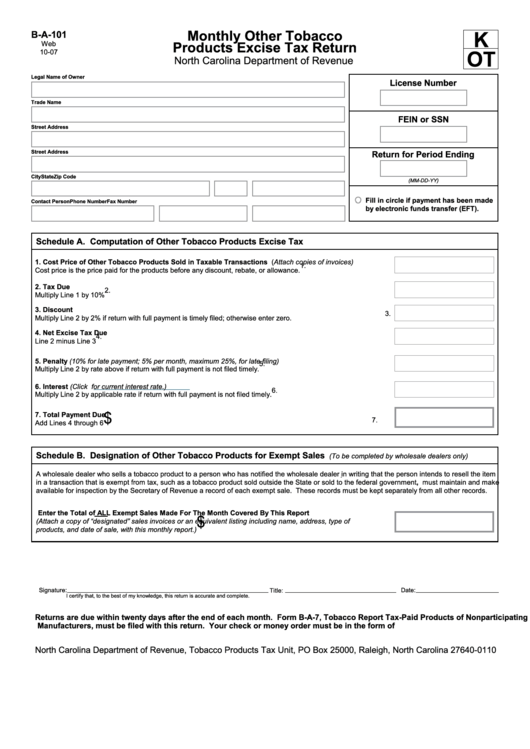

Monthly Other Tobacco

B-A-101

Products Excise Tax Return

Web

OT

10-07

North Carolina Department of Revenue

Legal Name of Owner

License Number

Trade Name

FEIN or SSN

Street Address

Street Address

Return for Period Ending

City

State

Zip Code

(MM-DD-YY)

Fill in circle if payment has been made

Contact Person

Phone Number

Fax Number

by electronic funds transfer (EFT).

Schedule A. Computation of Other Tobacco Products Excise Tax

1. Cost Price of Other Tobacco Products Sold in Taxable Transactions (Attach copies of invoices)

1.

Cost price is the price paid for the products before any discount, rebate, or allowance.

2. Tax Due

2.

Multiply Line 1 by 10%

3. Discount

3.

Multiply Line 2 by 2% if return with full payment is timely filed; otherwise enter zero.

4. Net Excise Tax Due

4.

Line 2 minus Line 3

5. Penalty (10% for late payment; 5% per month, maximum 25%, for late filing)

5.

Multiply Line 2 by rate above if return with full payment is not filed timely.

6. Interest (Click

for current interest rate.)

6.

Multiply Line 2 by applicable rate if return with full payment is not filed timely.

$

7. Total Payment Due

7.

Add Lines 4 through 6

Schedule B. Designation of Other Tobacco Products for Exempt Sales

(To be completed by wholesale dealers only)

A wholesale dealer who sells a tobacco product to a person who has notified the wholesale dealer in writing that the person intends to resell the item

in a transaction that is exempt from tax, such as a tobacco product sold outside the State or sold to the federal government, must maintain and make

available for inspection by the Secretary of Revenue a record of each exempt sale. These records must be kept separately from all other records.

Enter the Total of ALL Exempt Sales Made For The Month Covered By This Report

$

(Attach a copy of “designated” sales invoices or an equivalent listing including name, address, type of

products, and date of sale, with this monthly report.)

Signature:

Date:

Title:

I certify that, to the best of my knowledge, this return is accurate and complete.

Returns are due within twenty days after the end of each month. Form B-A-7, Tobacco Report Tax-Paid Products of Nonparticipating

Manufacturers, must be filed with this return. Your check or money order must be in the form of U.S. currency from a domestic bank.

North Carolina Department of Revenue, Tobacco Products Tax Unit, PO Box 25000, Raleigh, North Carolina 27640-0110

1

1