Instructions For Corporation Income Tax Amended Return Form Mo-1120x December 1997

ADVERTISEMENT

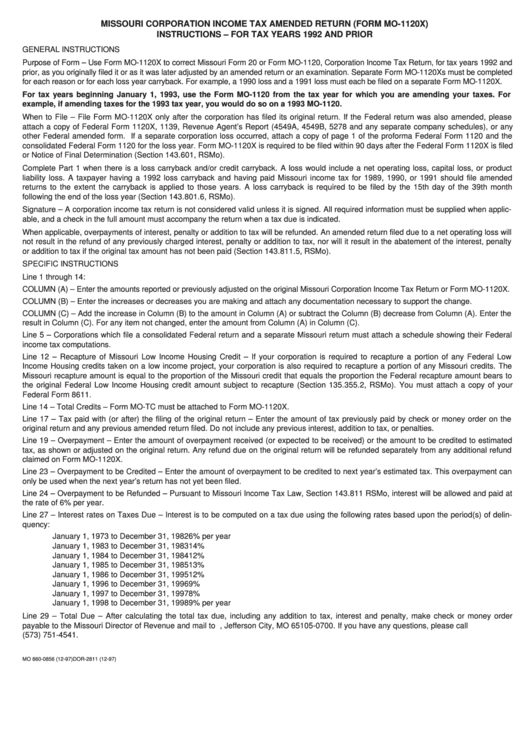

MISSOURI CORPORATION INCOME TAX AMENDED RETURN (FORM MO-1120X)

INSTRUCTIONS – FOR TAX YEARS 1992 AND PRIOR

GENERAL INSTRUCTIONS

Purpose of Form – Use Form MO-1120X to correct Missouri Form 20 or Form MO-1120, Corporation Income Tax Return, for tax years 1992 and

prior, as you originally filed it or as it was later adjusted by an amended return or an examination. Separate Form MO-1120Xs must be completed

for each reason or for each loss year carryback. For example, a 1990 loss and a 1991 loss must each be filed on a separate Form MO-1120X.

For tax years beginning January 1, 1993, use the Form MO-1120 from the tax year for which you are amending your taxes. For

example, if amending taxes for the 1993 tax year, you would do so on a 1993 MO-1120.

When to File – File Form MO-1120X only after the corporation has filed its original return. If the Federal return was also amended, please

attach a copy of Federal Form 1120X, 1139, Revenue Agent’s Report (4549A, 4549B, 5278 and any separate company schedules), or any

other Federal amended form. If a separate corporation loss occurred, attach a copy of page 1 of the proforma Federal Form 1120 and the

consolidated Federal Form 1120 for the loss year. Form MO-1120X is required to be filed within 90 days after the Federal Form 1120X is filed

or Notice of Final Determination (Section 143.601, RSMo).

Complete Part 1 when there is a loss carryback and/or credit carryback. A loss would include a net operating loss, capital loss, or product

liability loss. A taxpayer having a 1992 loss carryback and having paid Missouri income tax for 1989, 1990, or 1991 should file amended

returns to the extent the carryback is applied to those years. A loss carryback is required to be filed by the 15th day of the 39th month

following the end of the loss year (Section 143.801.6, RSMo).

Signature – A corporation income tax return is not considered valid unless it is signed. All required information must be supplied when applic-

able, and a check in the full amount must accompany the return when a tax due is indicated.

When applicable, overpayments of interest, penalty or addition to tax will be refunded. An amended return filed due to a net operating loss will

not result in the refund of any previously charged interest, penalty or addition to tax, nor will it result in the abatement of the interest, penalty

or addition to tax if the original tax amount has not been paid (Section 143.811.5, RSMo).

SPECIFIC INSTRUCTIONS

Line 1 through 14:

COLUMN (A) – Enter the amounts reported or previously adjusted on the original Missouri Corporation Income Tax Return or Form MO-1120X.

COLUMN (B) – Enter the increases or decreases you are making and attach any documentation necessary to support the change.

COLUMN (C) – Add the increase in Column (B) to the amount in Column (A) or subtract the Column (B) decrease from Column (A). Enter the

result in Column (C). For any item not changed, enter the amount from Column (A) in Column (C).

Line 5 – Corporations which file a consolidated Federal return and a separate Missouri return must attach a schedule showing their Federal

income tax computations.

Line 12 – Recapture of Missouri Low Income Housing Credit – If your corporation is required to recapture a portion of any Federal Low

Income Housing credits taken on a low income project, your corporation is also required to recapture a portion of any Missouri credits. The

Missouri recapture amount is equal to the proportion of the Missouri credit that equals the proportion the Federal recapture amount bears to

the original Federal Low Income Housing credit amount subject to recapture (Section 135.355.2, RSMo). You must attach a copy of your

Federal Form 8611.

Line 14 – Total Credits – Form MO-TC must be attached to Form MO-1120X.

Line 17 – Tax paid with (or after) the filing of the original return – Enter the amount of tax previously paid by check or money order on the

original return and any previous amended return filed. Do not include any previous interest, addition to tax, or penalties.

Line 19 – Overpayment – Enter the amount of overpayment received (or expected to be received) or the amount to be credited to estimated

tax, as shown or adjusted on the original return. Any refund due on the original return will be refunded separately from any additional refund

claimed on Form MO-1120X.

Line 23 – Overpayment to be Credited – Enter the amount of overpayment to be credited to next year’s estimated tax. This overpayment can

only be used when the next year’s return has not yet been filed.

Line 24 – Overpayment to be Refunded – Pursuant to Missouri Income Tax Law, Section 143.811 RSMo, interest will be allowed and paid at

the rate of 6% per year.

Line 27 – Interest rates on Taxes Due – Interest is to be computed on a tax due using the following rates based upon the period(s) of delin-

quency:

January 1, 1973 to December 31, 1982

6% per year

January 1, 1983 to December 31, 1983

14%

January 1, 1984 to December 31, 1984

12%

January 1, 1985 to December 31, 1985

13%

January 1, 1986 to December 31, 1995

12%

January 1, 1996 to December 31, 1996

9%

January 1, 1997 to December 31, 1997

8%

January 1, 1998 to December 31, 1998

9% per year

Line 29 – Total Due – After calculating the total tax due, including any addition to tax, interest and penalty, make check or money order

payable to the Missouri Director of Revenue and mail to P.O. Box 700, Jefferson City, MO 65105-0700. If you have any questions, please call

(573) 751-4541.

MO 860-0856 (12-97)

DOR-2811 (12-97)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1