Form Sev-5 - Report Of Severance Tax - Coal - 2007

ADVERTISEMENT

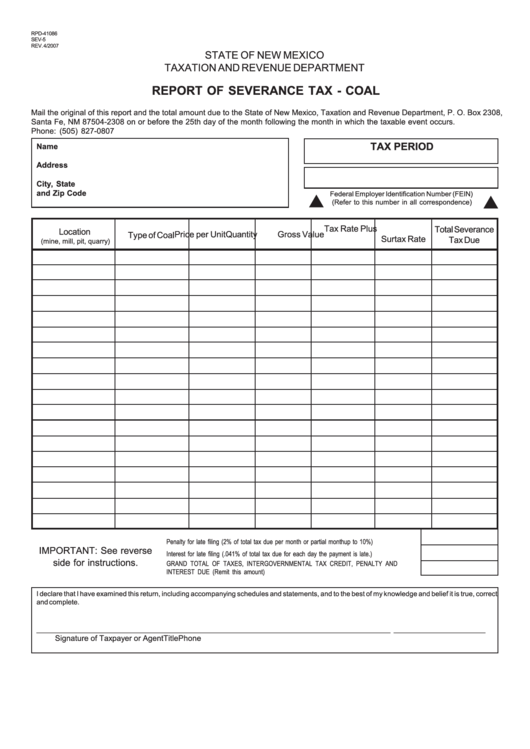

RPD-41086

SEV-5

REV. 4/2007

STATE OF NEW MEXICO

TAXATION AND REVENUE DEPARTMENT

REPORT OF SEVERANCE TAX - COAL

Mail the original of this report and the total amount due to the State of New Mexico, Taxation and Revenue Department, P. O. Box 2308,

Santa Fe, NM 87504-2308 on or before the 25th day of the month following the month in which the taxable event occurs.

Phone: (505) 827-0807

TAX PERIOD

Name

Address

City, State

and Zip Code

Federal Employer Identification Number (FEIN)

(Refer to this number in all correspondence)

Tax Rate Plus

Total Severance

Location

Price per Unit

Quantity

Gross Value

Type of Coal

Surtax Rate

Tax Due

(mine, mill, pit, quarry)

Penalty for late filing (2% of total tax due per month or partial month up to 10%) ........................

IMPORTANT: See reverse

Interest for late filing (.041% of total tax due for each day the payment is late.) ..........................

side for instructions.

GRAND TOTAL OF TAXES, INTERGOVERNMENTAL TAX CREDIT, PENALTY AND

INTEREST DUE (Remit this amount) ...............................................................................................

I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief it is true, correct

and complete.

________________________________ ___________________________ __________________ ____________________

Signature of Taxpayer or Agent

Title

Phone No.

Mo / Day / Year

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2