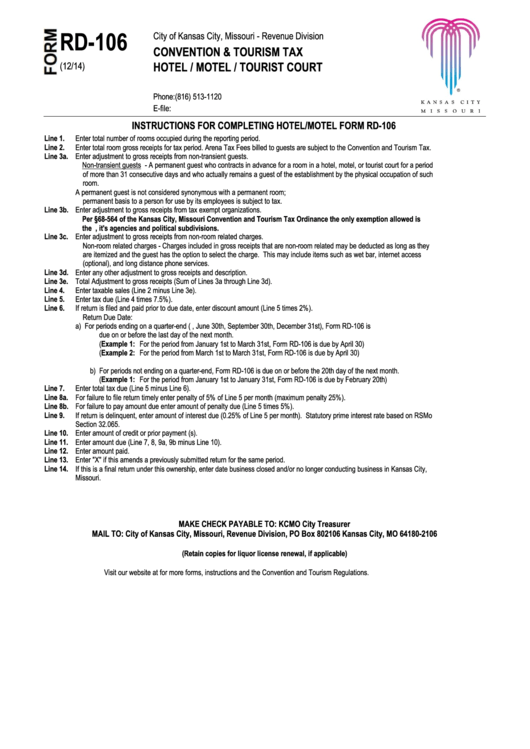

Form Rd-106 - Convention & Tourism Tax Hotel / Motel / Tourist Court - City Of Kansas City, Missouri - Revenue Division

ADVERTISEMENT

City of Kansas City, Missouri - Revenue Division

RD-106

CONVENTION & TOURISM TAX

(12/14)

HOTEL / MOTEL / TOURIST COURT

Phone:

(816) 513-1120

E-file:

kcmo.gov/quicktax

INSTRUCTIONS FOR COMPLETING HOTEL/MOTEL FORM RD-106

Line 1.

Enter total number of rooms occupied during the reporting period.

Line 2.

Enter total room gross receipts for tax period. Arena Tax Fees billed to guests are subject to the Convention and Tourism Tax.

Line 3a.

Enter adjustment to gross receipts from non-transient guests.

Non-transient guests

- A permanent guest who contracts in advance for a room in a hotel, motel, or tourist court for a period

of more than 31 consecutive days and who actually remains a guest of the establishment by the physical occupation of such

room.

A permanent guest is not considered synonymous with a permanent room; i.e. the rent or lease of accommodations on a

permanent basis to a person for use by its employees is subject to tax.

Line 3b.

Enter adjustment to gross receipts from tax exempt organizations.

Per §68-564 of the Kansas City, Missouri Convention and Tourism Tax Ordinance the only exemption allowed is

the U.S. Government, it's agencies and political subdivisions.

Line 3c.

Enter adjustment to gross receipts from non-room related charges.

Non-room related charges - Charges included in gross receipts that are non-room related may be deducted as long as they

are itemized and the guest has the option to select the charge. This may include items such as wet bar, internet access

(optional), and long distance phone services.

Line 3d.

Enter any other adjustment to gross receipts and description.

Line 3e.

Total Adjustment to gross receipts (Sum of Lines 3a through Line 3d).

Line 4.

Enter taxable sales (Line 2 minus Line 3e).

Line 5.

Enter tax due (Line 4 times 7.5%).

Line 6.

If return is filed and paid prior to due date, enter discount amount (Line 5 times 2%).

Return Due Date:

a) For periods ending on a quarter-end (i.e. March 31st, June 30th, September 30th, December 31st), Form RD-106 is

due on or before the last day of the next month.

(

Example 1:

For the period from January 1st to March 31st, Form RD-106 is due by April 30)

(

Example 2:

For the period from March 1st to March 31st, Form RD-106 is due by April 30)

b) For periods not ending on a quarter-end, Form RD-106 is due on or before the 20th day of the next month.

(

Example 1:

For the period from January 1st to January 31st, Form RD-106 is due by February 20th)

Line 7.

Enter total tax due (Line 5 minus Line 6).

Line 8a.

For failure to file return timely enter penalty of 5% of Line 5 per month (maximum penalty 25%).

Line 8b.

For failure to pay amount due enter amount of penalty due (Line 5 times 5%).

Line 9.

If return is delinquent, enter amount of interest due (0.25% of Line 5 per month). Statutory prime interest rate based on RSMo

Section 32.065.

Line 10.

Enter amount of credit or prior payment (s).

Line 11.

Enter amount due (Line 7, 8, 9a, 9b minus Line 10).

Line 12.

Enter amount paid.

Line 13.

Enter "X" if this amends a previously submitted return for the same period.

Line 14.

If this is a final return under this ownership, enter date business closed and/or no longer conducting business in Kansas City,

Missouri.

MAKE CHECK PAYABLE TO: KCMO City Treasurer

MAIL TO: City of Kansas City, Missouri, Revenue Division, PO Box 802106 Kansas City, MO 64180-2106

(Retain copies for liquor license renewal, if applicable)

Visit our website at kcmo.gov/revenue for more forms, instructions and the Convention and Tourism Regulations.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1