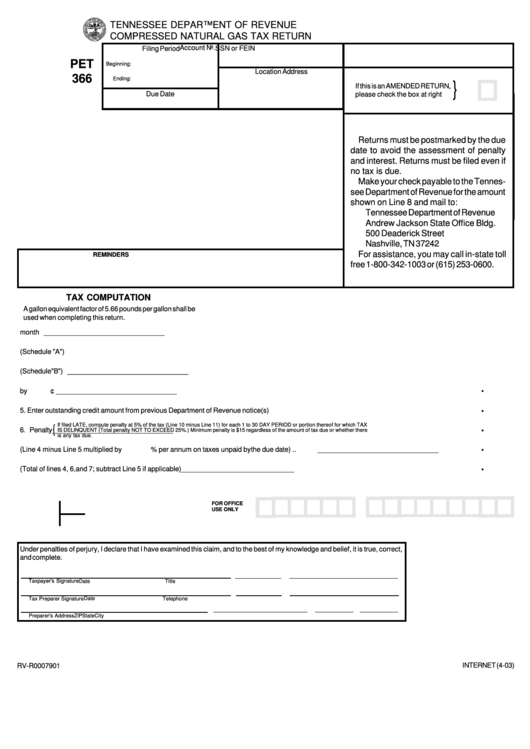

Form Pet 366 - Compressed Natural Gas Tax Return Form - Tennessee Department Of Revenue

ADVERTISEMENT

TENNESSEE DEPARTMENT OF REVENUE

COMPRESSED NATURAL GAS TAX RETURN

Account No.

SSN or FEIN

Filing Period

PET

Beginning:

Location Address

366

Ending:

}

If this is an AMENDED RETURN,

Due Date

please check the box at right

Returns must be postmarked by the due

date to avoid the assessment of penalty

and interest. Returns must be filed even if

no tax is due.

Make your check payable to the Tennes-

see Department of Revenue for the amount

shown on Line 8 and mail to:

Tennessee Department of Revenue

Andrew Jackson State Office Bldg.

500 Deaderick Street

Nashville, TN 37242

For assistance, you may call in-state toll

REMINDERS

1. Read line instructions carefully when completing this return.

free 1-800-342-1003 or (615) 253-0600.

2. Complete all information and schedules.

3. Transfer totals from schedules to appropriate lines.

4. Sign and date your return in the signature box.

TAX COMPUTATION

A gallon equivalent factor of 5.66 pounds per gallon shall be

used when completing this return.

1. Gallons of fuel received during the month ..................................................................................................................

_______________________________

2. Gallons of fuel delivered into licensed vehicles from nontaxable source. (Schedule "A") ...........................................

_______________________________

3. Gallons of fuel used for all purposes other than in a licensed vehicle. (Schedule "B") ...............................................

_______________________________

.

4. Total Tax Due - Multiply Line 2 by

¢ ................................................................................................................

_______________________________

.

5. Enter outstanding credit amount from previous Department of Revenue notice(s) ....................................................

_______________________________

.

If filed LATE, compute penalty at 5% of the tax (Line 10 minus Line 11) for each 1 to 30 DAY PERIOD or portion thereof for which TAX

{

6. Penalty

_______________________________

IS DELINQUENT (Total penalty NOT TO EXCEED 25%.) Minimum penalty is $15 regardless of the amount of tax due or whether there

is any tax due.

.

7. Interest (Line 4 minus Line 5 multiplied by

% per annum on taxes unpaid by the due date) .........................

_______________________________

.

8. TOTAL REMITTANCE AMOUNT (Total of lines 4, 6, and 7; subtract Line 5 if applicable) ........................................

_______________________________

FOR OFFICE

USE ONLY

Under penalties of perjury, I declare that I have examined this claim, and to the best of my knowledge and belief, it is true, correct,

and complete.

Taxpayer's Signature

Date

Title

Tax Preparer Signature

Date

Telephone

Preparer's Address

City

State

ZIP

INTERNET (4-03)

RV-R0007901

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4