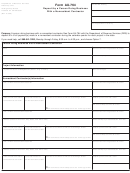

Form Au-764 - Deposit By A Person Doing Business With A Nonresident Contractor Page 3

ADVERTISEMENT

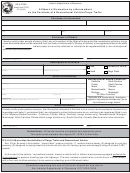

Enter the Federal Employer Identification Number (FEIN) of

General Instructions

the person doing business with the nonresident contractor. If

A person doing business with a nonresident contractor working

the person doing business with the nonresident contractor does

in Connecticut must submit Form AU-764, Deposit by a Person

not have an FEIN, enter that person’s Social Security Number.

Doing Business With a Nonresident Contractor, with a deposit

of 5% of any payment of the total contract price, including

Project Information

change orders and add-ons, by the last day of the month

Enter the complete address, including the street address and

following the calendar quarter that follows the calendar quarter

the city or town where the project is physically located, and

in which the first payment to the nonresident contractor was

the name of the project. If you use Form AU-764a to report

made and every calendar quarter thereafter. This applies to all

payments to more than three nonresident contractors working

contracts with nonresident contractors, regardless of the nature

on a specific project during the period, identify the project by

of the real property affected or the tax-exempt status of the

location and enter the same project number as was entered on

property owner. For more information, see Special Notice

Form AU-764.

2005(12), Nonresident Contractors Bonds and Deposits.

Enter the name and complete address of the nonresident

The person doing business with a nonresident contractor is

contractor(s) on whose behalf the deposit is being made.

not required to withhold 5% of any payment made to the

Include the nonresident contractor’s Connecticut tax registration

contractor if the contractor provides a Certificate of Compliance

number and FEIN.

issued by the Department of Revenue Services (DRS) stating

that the contractor has filed

a guarantee bond or a cash bond

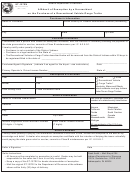

Nonresident Contractor Information

for 5% of the total contract price.

Enter the commencement date of this project for the nonresident

contractor. The commencement date is the date the contract

Use Form AU-764 each quarterly period to report payments

is signed or the date the nonresident contractor begins work

made to nonresident contractors for:

on the project, but it is never later than the date the nonresident

•

One project with one or more nonresident contractor(s); or

contractor begins work.

•

More than one project with one or more nonresident

Enter the date on which each nonresident contractor’s work on

contractor(s) on each project.

this project is expected to be completed, which is the date the

If you need additional space, attach as many Forms AU-764a,

final periodic billing for the contract will be made by the

Form AU-764 Continuation Schedule, as necessary.

nonresident contractor. Note the final periodic billing may be

due before payment of any retainage becomes due. The person

A nonresident contractor is a contractor who does not maintain

making the deposit must attach a copy of the final periodic

a regular place of business in this state.

A regular place of

billing to Form AU-764.

business means any bona fide office, factory, warehouse, or

other space in Connecticut at which a contractor is doing

If this is a deposit for a change order occurring after the deposit

business in its own name in a regular and systematic manner,

for the initial contract has been remitted to DRS, enter the

and which place is continuously maintained, occupied, and

additional amount being deposited for the change order and

used by the contractor in carrying on its business through its

check the box. For a change order made after the final periodic

employees regularly in attendance to carry on the contractor’s

billing for the original contract, the change order is deemed

business in the contractor’s own name. A regular place of

complete when it is billed by the nonresident contractor. Attach

business does not include a place of business for a statutory

a copy of the final billing for the change order.

agent for service of process or a temporary office whether or

Enter, in words and figures, the total amount paid to the

not it is located at the site of construction. A regular place of

nonresident contractor under the contract or for the change

business also does not include locations used by the contractor

order. Check the box if the deposit is for a change order.

only for the duration of the contract, such as short-term leased

offices, warehouses, storage facilities, or facilities that do not

Enter the total of all payments made to the nonresident

have full time staff with regular business hours. An office

contractor during the calendar quarter.

maintained, occupied and used by a person affiliated with a

Multiply the total payments to the nonresident contractor during

contractor is not a regular place of business of the contractor.

the calendar quarter by 5% (.05) and enter the result on this

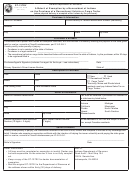

Specific Instructions

line.

Enter the period ending date for the calendar quarter in which

If you are reporting payments to a nonresident contractor for

the payment to a nonresident contractor was made. Enter the

more than one project, separately list the payments to that

due date of the deposit. The deposit is due the last day of the

nonresident contractor for each project.

month following the calendar quarter that follows the calendar

Declaration: An authorized representative of the person doing

quarter in which the payment to the nonresident contractor was

business with a nonresident contractor must sign and date the

made.

declaration. Return Form AU-764, with the copy of the final

Person Doing Business With a Nonresident Contractor

periodic billing, to:

Enter the name and complete address of the person doing

Department of Revenue Services

business with the nonresident contractor. If the nonresident

Discovery Unit

contractor is the general contractor, enter the name and address

25 Sigourney Street

of the owner of the property. If the nonresident contractor is a

Hartford CT 06106

subcontractor, enter the name and address of the general

contractor.

Form AU-764 Page 3 (Rev. 03/06)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3