Form Ir - Income Tax Return - City Of Springdale

ADVERTISEMENT

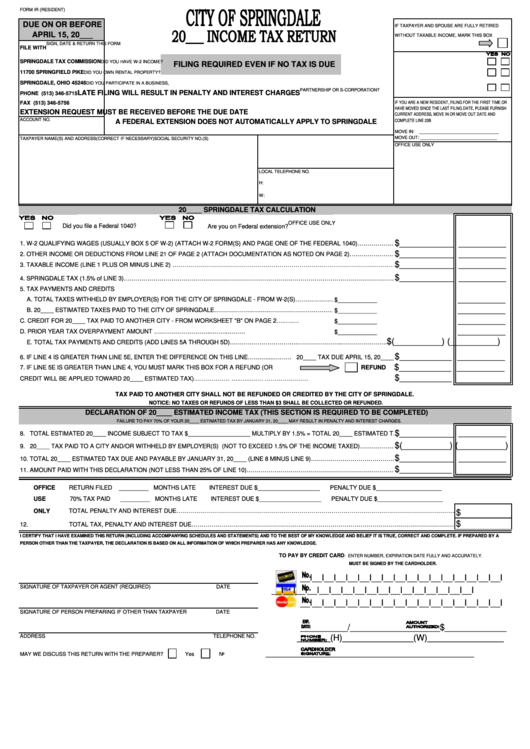

FORM IR (RESIDENT)

DUE ON OR BEFORE

IF TAXPAYER AND SPOUSE ARE FULLY RETIRED

APRIL 15, 20___

WITHOUT TAXABLE INCOME, MARK THIS BOX

SIGN, DATE & RETURN THIS FORM

FILE WITH

SPRINGDALE TAX COMMISSION

DID YOU HAVE W-2 INCOME?

FILING REQUIRED EVEN IF NO TAX IS DUE

11700 SPRINGFIELD PIKE

DID YOU OWN RENTAL PROPERTY?

SPRINGDALE, OHIO 45246

DID YOU PARTICIPATE IN A BUSINESS,

PARTNERSHIP OR S-CORPORATION?

LATE FILING WILL RESULT IN PENALTY AND INTEREST CHARGES

PHONE (513) 346-5715

IF YOU ARE A NEW RESIDENT, FILING FOR THE FIRST TIME OR

FAX (513) 346-5756

HAVE MOVED SINCE THE LAST FILING DATE, PLEASE FURNISH

EXTENSION REQUEST MUST BE RECEIVED BEFORE THE DUE DATE

CURRENT ADDRESS, MOVE IN OR MOVE OUT DATE AND

COMPLETE LINE 20B

ACCOUNT NO.

A FEDERAL EXTENSION DOES NOT AUTOMATICALLY APPLY TO SPRINGDALE

MOVE IN:

_________________________________

MOVE OUT: ________________________________

TAXPAYER NAME(S) AND ADDRESS

(CORRECT IF NECESSARY)

SOCIAL SECURITY NO.(S)

OFFICE USE ONLY

LOCAL TELEPHONE NO.

H:

W:

20____ SPRINGDALE TAX CALCULATION

OFFICE USE ONLY

Did you file a Federal 1040?

Are you on Federal extension?

$____________ __________

1. W-2 QUALIFYING WAGES (USUALLY BOX 5 OF W-2) (ATTACH W-2 FORM(S) AND PAGE ONE OF THE FEDERAL 1040)……………….

$____________ __________

2. OTHER INCOME OR DEDUCTIONS FROM LINE 21 OF PAGE 2 (ATTACH DOCUMENTATION AS NOTED ON PAGE 2)………………………………………………………………………………

$____________ __________

3. TAXABLE INCOME (LINE 1 PLUS OR MINUS LINE 2) ………………………………………………………………………………………………………………………………………………………..

$____________ __________

4. SPRINGDALE TAX (1.5% of LINE 3)……………………………………………………………………………………………………………………………………………………………………………………

5. TAX PAYMENTS AND CREDITS

__________

A. TOTAL TAXES WITHHELD BY EMPLOYER(S) FOR THE CITY OF SPRINGDALE - FROM W-2(S)…………………………………………………………………

$____________

__________

B. 20____ ESTIMATED TAXES PAID TO THE CITY OF SPRINGDALE………………..….….…………………………………………………….

$____________

__________

C. CREDIT FOR 20____ TAX PAID TO ANOTHER CITY - FROM WORKSHEET "B" ON PAGE 2….…..…...........................................................

$____________

__________

D. PRIOR YEAR TAX OVERPAYMENT AMOUNT ………………………...……..………..............................................................

$____________

$(__________) (__________)

E. TOTAL TAX PAYMENTS AND CREDITS (ADD LINES 5A THROUGH 5D)…………………………….…………………..…………………..

$ ___________ __________

6. IF LINE 4 IS GREATER THAN LINE 5E, ENTER THE DIFFERENCE ON THIS LINE…….…...…….… 20____ TAX DUE APRIL 15, 20____

$___________ __________

7. IF LINE 5E IS GREATER THAN LINE 4, YOU MUST MARK THIS BOX FOR A REFUND (OR

REFUND

$___________

CREDIT WILL BE APPLIED TOWARD 20____ ESTIMATED TAX)……………….....…..…...……....………….………...............20____ CREDIT

TAX PAID TO ANOTHER CITY SHALL NOT BE REFUNDED OR CREDITED BY THE CITY OF SPRINGDALE.

NOTICE: NO TAXES OR REFUNDS OF LESS THAN $3 SHALL BE COLLECTED OR REFUNDED.

DECLARATION OF 20____ ESTIMATED INCOME TAX (THIS SECTION IS REQUIRED TO BE COMPLETED)

FAILURE TO PAY 70% OF YOUR 20____ ESTIMATED TAX BY JANUARY 31, 20____ MAY RESULT IN PENALTY AND INTEREST CHARGES.

$____________ __________

8. TOTAL ESTIMATED 20____ INCOME SUBJECT TO TAX $___________________ MULTIPLY BY 1.5% = TOTAL 20____ ESTIMATED TAX………………………

$(__________) (__________)

9. 20____ TAX PAID TO A CITY AND/OR WITHHELD BY EMPLOYER(S) (NOT TO EXCEED 1.5% OF THE INCOME TAXED)…………………………………………

$_____________ __________

10. TOTAL 20____ ESTIMATED TAX DUE AND PAYABLE BY JANUARY 31, 20____ (LINE 8 MINUS LINE 9)………………………………………………………………………………………………

$___________

11. AMOUNT PAID WITH THIS DECLARATION (NOT LESS THAN 25% OF LINE 10)……………………………………………………………………………………………………………………..

OFFICE

RETURN FILED

_________ MONTHS LATE

INTEREST DUE $___________________

PENALTY DUE $____________________

USE

70% TAX PAID

_________ MONTHS LATE

INTEREST DUE $___________________

PENALTY DUE $____________________

ONLY

TOTAL PENALTY AND INTEREST DUE……………………………………………………………………………………………………………………………………………………………

$

$

12.

TOTAL TAX, PENALTY AND INTEREST DUE……………………………………………………………………………………………………………………………………………………

I CERTIFY THAT I HAVE EXAMINED THIS RETURN (INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS) AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IT IS TRUE, CORRECT AND COMPLETE. IF PREPARED BY A

PERSON OTHER THAN THE TAXPAYER, THE DECLARATION IS BASED ON ALL INFORMATION OF WHICH PREPARER HAS ANY KNOWLEDGE.

TO PAY BY CREDIT CARD

: ENTER NUMBER, EXPIRATION DATE FULLY AND ACCURATELY.

MUST BE SIGNED BY THE CARDHOLDER.

__I__I__I__I__I__I__I__I__I__I__I__I__I__I__I__I__I

SIGNATURE OF TAXPAYER OR AGENT (REQUIRED)

DATE

__I__I__I__I__I__I__I__I__I__I__I__I__I__I__I__I__I

__I__I__I__I__I__I__I__I__I__I__I__I__I__I__I__I__I

SIGNATURE OF PERSON PREPARING IF OTHER THAN TAXPAYER

DATE

__________/___________________$_____________

ADDRESS

TELEPHONE NO.

_______(H)_______________(W)________________

____________________________________________

MAY WE DISCUSS THIS RETURN WITH THE PREPARER?

Yes

No

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2