Form It-560-C - Payment Of Income Tax And/or Net Worth Tax

ADVERTISEMENT

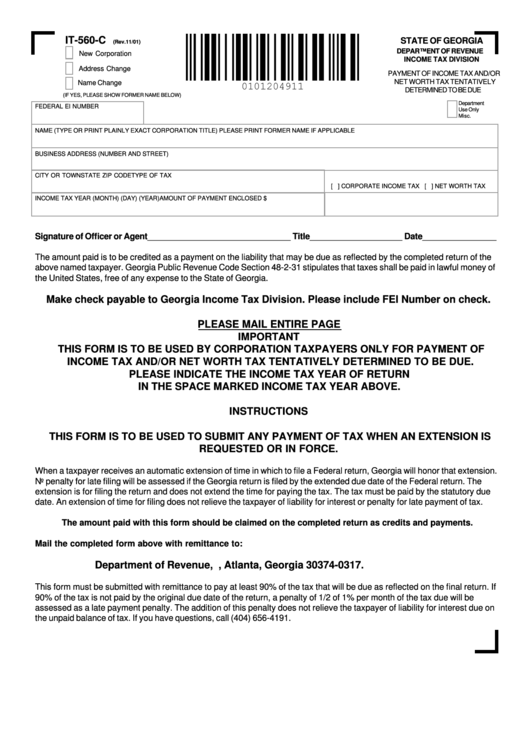

IT-560-C

STATE OF GEORGIA

(Rev.11/01)

DEPARTMENT OF REVENUE

New Corporation

INCOME TAX DIVISION

Address Change

PAYMENT OF INCOME TAX AND/OR

NET WORTH TAX TENTATIVELY

Name Change

DETERMINED TO BE DUE

(IF YES, PLEASE SHOW FORMER NAME BELOW)

Department

FEDERAL EI NUMBER

Use Only

Misc.

NAME (TYPE OR PRINT PLAINLY EXACT CORPORATION TITLE) PLEASE PRINT FORMER NAME IF APPLICABLE

BUSINESS ADDRESS (NUMBER AND STREET)

CITY OR TOWN

STATE

ZIP CODE

TYPE OF TAX

[ ] CORPORATE INCOME TAX [ ] NET WORTH TAX

INCOME TAX YEAR (MONTH) (DAY) (YEAR)

AMOUNT OF PAYMENT ENCLOSED $

Signature of Officer or Agent_______________________________ Title____________________ Date________________

The amount paid is to be credited as a payment on the liability that may be due as reflected by the completed return of the

above named taxpayer. Georgia Public Revenue Code Section 48-2-31 stipulates that taxes shall be paid in lawful money of

the United States, free of any expense to the State of Georgia.

Make check payable to Georgia Income Tax Division. Please include FEI Number on check.

PLEASE MAIL ENTIRE PAGE

IMPORTANT

THIS FORM IS TO BE USED BY CORPORATION TAXPAYERS ONLY FOR PAYMENT OF

INCOME TAX AND/OR NET WORTH TAX TENTATIVELY DETERMINED TO BE DUE.

PLEASE INDICATE THE INCOME TAX YEAR OF RETURN

IN THE SPACE MARKED INCOME TAX YEAR ABOVE.

INSTRUCTIONS

THIS FORM IS TO BE USED TO SUBMIT ANY PAYMENT OF TAX WHEN AN EXTENSION IS

REQUESTED OR IN FORCE.

When a taxpayer receives an automatic extension of time in which to file a Federal return, Georgia will honor that extension.

No penalty for late filing will be assessed if the Georgia return is filed by the extended due date of the Federal return. The

extension is for filing the return and does not extend the time for paying the tax. The tax must be paid by the statutory due

date. An extension of time for filing does not relieve the taxpayer of liability for interest or penalty for late payment of tax.

The amount paid with this form should be claimed on the completed return as credits and payments.

Mail the completed form above with remittance to:

Department of Revenue, P.O. Box 740317, Atlanta, Georgia 30374-0317.

This form must be submitted with remittance to pay at least 90% of the tax that will be due as reflected on the final return. If

90% of the tax is not paid by the original due date of the return, a penalty of 1/2 of 1% per month of the tax due will be

assessed as a late payment penalty. The addition of this penalty does not relieve the taxpayer of liability for interest due on

the unpaid balance of tax. If you have questions, call (404) 656-4191.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1