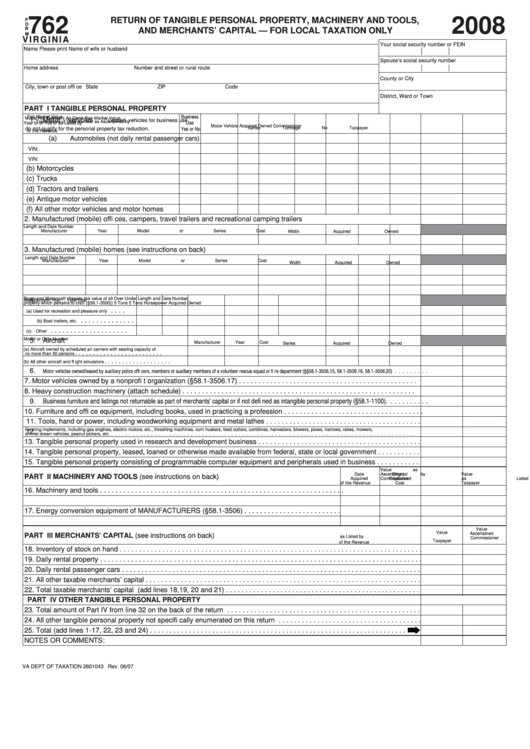

Virginia Form 762 - Return Of Tangible Personal Property, Machinery And Tools,and Merchants' Capital - 2008

ADVERTISEMENT

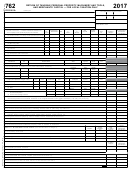

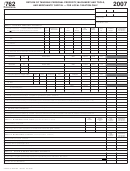

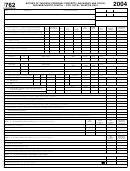

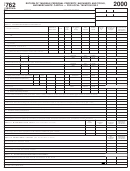

762

2008

RETURN OF TANGIBLE PERSONAL PROPERTY, MACHINERY AND TOOLS,

F

O

R

AND MERCHANTS’ CAPITAL — FOR LOCAL TAXATION ONLY

M

V I R G I N I A

Your social security number or FEIN

Name

Please print

Name of wife or husband

Spouse’s social security number

Home address

Number and street or rural route

County or City

City, town or post offi ce

State

ZIP Code

District, Ward or Town

PART I TANGIBLE PERSONAL PROPERTY

Business

Fair Market Value

Model

No. Cylinders

Air Cond.

Fair Market Value

1. Motor vehicles

* Leased vehicles for business use

Trade Name of

Date

Number

as Ascertained by

Use

Year

or

or

Yes or

as Listed by

Motor Vehicle

Acquired

Owned

Commissioner

Yes or No

Series

Tonnage

No

Taxpayer

do not qualify for the personal property tax reduction.

of the Revenue

(a)

Automobiles (not daily rental passenger cars)

VIN:

VIN:

(b) Motorcycles

(c) Trucks

(d) Tractors and trailers

(e) Antique motor vehicles

(f) All other motor vehicles and motor homes

2. Manufactured (mobile) offi ces, campers, travel trailers and recreational camping trailers

Length and

Date

Number

Manufacturer

Year

Model or Series

Cost

Width

Acquired

Owned

3. Manufactured (mobile) homes (see instructions on back)

Length and

Date

Number

Manufacturer

Year

Model or Series

Cost

Width

Acquired

Owned

Boats and Watercraft (Assess the value of all

Over

Under

Length and

Date

Number

4.

Manufacturer

Year

Type

Cost

property which pertains to craft (§58.1-3500))

5 Tons

5 Tons

Horsepower

Acquired

Owned

. . . .

(a) Used for recreation and pleasure only

. . . . . . . . . . . . . .

(b) Boat trailers, etc.

. . . . . . . . . . . . . . . . . . . .

(c) Other

5. Aircraft

Model or

Date

Number

Manufacturer

Year

Cost

Series

Acquired

Owned

(a) Aircraft owned by scheduled air carriers with seating capacity of

no more than 50 persons . . . . . . . . . . . . . . . . . . . . . . . . .

(b) All other aircraft and fl ight simulators . . . . . . . . . . . . . . . . . . .

6.

Motor vehicles owned/leased by auxiliary police offi cers, members or auxiliary members of a volunteer rescue squad or fi re department (§§58.1-3506.15, 58.1-3506.16, 58.1-3506.20)

. . . . . . . . .

7. Motor vehicles owned by a nonprofi t organization (§58.1-3506.17) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8. Heavy construction machinery (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9. Business furniture and listings not returnable as part of merchants’ capital or if not defi ned as intangible personal property (§58.1-1100). . . . . . . . . . .

10. Furniture and offi ce equipment, including books, used in practicing a profession . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11. Tools, hand or power, including woodworking equipment and metal lathes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Farming implements, including gas engines, electric motors, etc., threshing machines, corn huskers, feed cutters, combines, harvesters, blowers, plows, harrows, rakes, mowers,

12.

animal drawn vehicles, peanut pickers, etc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13. Tangible personal property used in research and development business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14. Tangible personal property, leased, loaned or otherwise made available from federal, state or local government . . . . . . . . . . .

15. Tangible personal property consisting of programmable computer equipment and peripherals used in business . . . . . . . . . . .

Value as

Date

Original

Value

Ascertained by

PART II MACHINERY AND TOOLS (see instructions on back)

Acquired

Capitalized

as Listed by

Commissioner

of the Revenue

Cost

Taxpayer

16. Machinery and tools . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17. Energy conversion equipment of MANUFACTURERS (§58.1-3506) . . . . . . . . . . . . . . . . . . . . . . . . .

Value as

Value

Ascertained by

PART III MERCHANTS’ CAPITAL (see instructions on back)

as Listed by

Commissioner

Taxpayer

of the Revenue

18. Inventory of stock on hand . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19. Daily rental property . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20. Daily rental passenger cars . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21. All other taxable merchants’ capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22. Total taxable merchants’ capital (add lines 18,19, 20 and 21) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

PART IV OTHER TANGIBLE PERSONAL PROPERTY

23. Total amount of Part IV from line 32 on the back of the return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24. All other tangible personal property not specifi cally enumerated on this return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25. Total (add lines 1-17, 22, 23 and 24) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

NOTES OR COMMENTS:

VA DEPT OF TAXATION

2601043 Rev. 06/07

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2