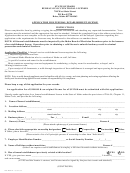

WORKSHEET FOR QUARTER-MONTHLY WITHHOLDING

Filers of Form RD-130Q/M complete the worksheet below:

1.

Enter in Column A the actual tax withheld during each quarter-monthly period.

2.

Enter in Column B the payment made for each quarter-monthly period.

3.

Enter in Column C the amount of Column A minus the amount of Column B.

4.

Enter penalty and interest amount if any under Column D.

5.

Add the amounts in Columns C and D, and enter the total in Column E for each quarter-monthly

period.

6.

Add the total amount due in Column E and enter this figure on Line 6 on form RD-110.

This is the amount to be remitted along with the completed return (RD-110)

A

B

C

D

E

TAX

PENALTY/

AMOUNT

MONTH QUARTER-MONTH

WITHHELD

TAX PAID

UNDERPAYMENT

INTEREST

DUE

1st thru 7th Day

1ST

8th thru 15th Day

16th thru 22nd Day

23rd thru Last Day

1st thru 7th Day

8th thru 15th Day

2ND

16th thru 22nd Day

23rd thru Last Day

1st thru 7th Day

3RD

8th thru 15th Day

16th thru 22nd Day

23rd thru Last Day

TOTAL

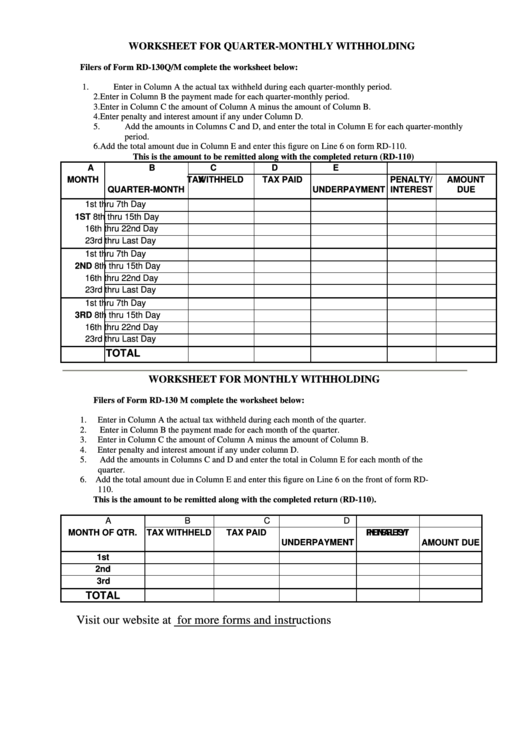

WORKSHEET FOR MONTHLY WITHHOLDING

Filers of Form RD-130 M complete the worksheet below:

1.

Enter in Column A the actual tax withheld during each month of the quarter.

2.

Enter in Column B the payment made for each month of the quarter.

3.

Enter in Column C the amount of Column A minus the amount of Column B.

4.

Enter penalty and interest amount if any under column D.

5.

Add the amounts in Columns C and D and enter the total in Column E for each month of the

quarter.

6.

Add the total amount due in Column E and enter this figure on Line 6 on the front of form RD-

110.

This is the amount to be remitted along with the completed return (RD-110).

A

B

C

D

PENALTY/

MONTH OF QTR. TAX WITHHELD

TAX PAID

UNDERPAYMENT

INTEREST

AMOUNT DUE

1st

2nd

3rd

TOTAL

Visit our website at for more forms and instructions

1

1 2

2