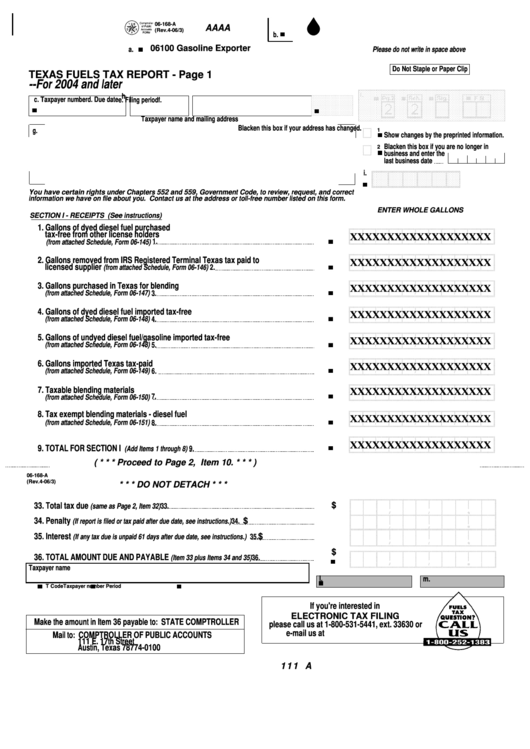

06-168-A

AAAA

PRINT

(Rev.4-06/3)

b.

06100 Gasoline Exporter

a.

Please do not write in space above

Do Not Staple or Paper Clip

TEXAS FUELS TAX REPORT - Page 1

--For 2004 and later

h.

c. Taxpayer number

d. Due date

e. Filing period

f.

Taxpayer name and mailing address

Blacken this box if your address has changed.

g.

1

Show changes by the preprinted information.

Blacken this box if you are no longer in

2

business and enter the

last business date

i.

You have certain rights under Chapters 552 and 559, Government Code, to review, request, and correct

information we have on file about you. Contact us at the address or toll-free number listed on this form.

ENTER WHOLE GALLONS

SECTION I - RECEIPTS (See instructions)

1. Gallons of dyed diesel fuel purchased

XXXXXXXXXXXXXXXXXXX

tax-free from other license holders

1.

(from attached Schedule, Form 06-145)

XXXXXXXXXXXXXXXXXXX

2. Gallons removed from IRS Registered Terminal Texas tax paid to

licensed supplier

2.

(from attached Schedule, Form 06-146)

XXXXXXXXXXXXXXXXXXX

3. Gallons purchased in Texas for blending

(from attached Schedule, Form 06-147)

3.

XXXXXXXXXXXXXXXXXXX

4. Gallons of dyed diesel fuel imported tax-free

(from attached Schedule, Form 06-148)

4.

5. Gallons of undyed diesel fuel/gasoline imported tax-free

XXXXXXXXXXXXXXXXXXX

(from attached Schedule, Form 06-148)

5.

6. Gallons imported Texas tax-paid

XXXXXXXXXXXXXXXXXXX

(from attached Schedule, Form 06-149)

6.

XXXXXXXXXXXXXXXXXXX

7. Taxable blending materials

7.

(from attached Schedule, Form 06-150)

8. Tax exempt blending materials - diesel fuel

XXXXXXXXXXXXXXXXXXX

(from attached Schedule, Form 06-151)

8.

XXXXXXXXXXXXXXXXXXX

9. TOTAL FOR SECTION I

(Add Items 1 through 8)

9.

( * * * Proceed to Page 2, Item 10. * * * )

06-168-A

(Rev.4-06/3)

* * * DO NOT DETACH * * *

33. Total tax due

$

(same as Page 2, Item 32)

33.

34. Penalty

$

34.

(If report is filed or tax paid after due date, see instructions.)

35. Interest

$

35.

(If any tax due is unpaid 61 days after due date, see instructions.)

$

36. TOTAL AMOUNT DUE AND PAYABLE

(Item 33 plus Items 34 and 35)

36.

Taxpayer name

l.

m.

T Code

Taxpayer number

Period

If you're interested in

ELECTRONIC TAX FILING

Make the amount in Item 36 payable to: STATE COMPTROLLER

please call us at 1-800-531-5441, ext. 33630 or

e-mail us at etf.cpa@cpa.state.tx.us

Mail to: COMPTROLLER OF PUBLIC ACCOUNTS

111 E. 17th Street

Austin, Texas 78774-0100

111 A

1

1 2

2 3

3 4

4