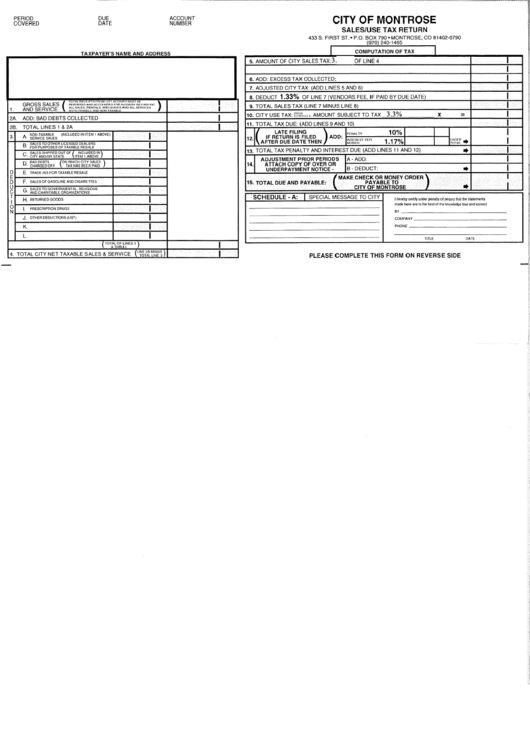

Sales / Use Tax Return Form - City Of Montrose

ADVERTISEMENT

PERIOD

COVERED

DUE

DATE

ACCOUNT

NUMBER

TAXPAYER'S N AME AND ADDRESS

GROSS SALES (

TOTALAEC.ElPTS FROM CITY ACTIVITY MUST BE

)

REPORTED MID ACCOUIIlEO FOR IN EVERY AETUAII tuG

1.

AND SERVICE

~~\~AT~~~E:

1

1{'i;st~~~~~~~

Aim

ALL SERVICES

2A.

ADD: BAD DEBTS COLLECTED

28. TOTAL LINES 1

&

2A

3.

A.

NON-TAXABLE

(INCLUDED IN ITEM 1 ABOVE)

SERVICE SALES

B.

SALES TO OTHER LICENSED DEALERS

FOR PURPOSES OFT AXABLE RESALE

C.

~~~J~:~~~~fr~T

OF

(IT~~~;~~~~)

D.

BAD DEBTS

(o~r~H~~ ~~JJrf~~fg

)

CHARGED OFF

D

E.

TRADE-INS FOR TAXABLE RESALE

E

D

F.

SALES OF GASOLINE AND CIGARETIES

u

G.

SALES TO GOVERNMENTAL, RELIGIOUS

c

AND CHARITABLE ORGANIZATIONS

T

H.

RETURNED GOODS

I

0

I.

PRESCAIPTIDrl DRUGS

N

J.

OTHER DEDUCTIONS 'LIST)

K.

L.

(

ror:~~~JLNES

3 )

4. TOTAL CITY NET TAXABLE SALES

&

SERVICE

("}'M"c'~:N~;)

I

I

I

I

I

CITY OF MONTROSE

SALES/USE TAX RETURN

433 S. FIRST ST • P

0

BOX 790 • MONTROSE CO 81402-0790

(970) 240-1465

I

COMPUTATION OF TAX

I

5. AMOUNT OF CITY SALES TAX:

OF LINE 4

I

6. ADD: EXCESS TAX COLLECTED:

7. ADJUSTED CITY TAX: (ADD LINES 5 AND 6)

8. DEDUCT

1.33%

OF LINE 7 (VENDORS FEE, IF PAID BY DUE DATE)

9. TOTAL SALES TAX (LINE 7 MINUS LINE 8)

10. CITY USE TAX:

!:c':ic~"

e AMOUNT SUBJECT TO TAX

X

=

11. TOTAL TAX DUE: (ADD LINES 9 AND 10)

~.1(

IF

R~';-1ER~T~N~LED

) ADD: lm,ALTY

1o%T

I

I

12

AFTER DUE DATE THEN

~~~~~~ST

PER

1.17%1

I

l~gi~t~

..

13. TOTAL TAX PENALTY AND INTEREST DUE (ADD LINES 11 AND 12)

..

I.

I

ADJUSTMENT PRIOR PERIODS

lA- ADD:

14

ATTACH COPY OF OVER OR

UNDERPAYMENT NOTICE-

IB- DEDUCT:

..

(MAKE CHECK OR MONEY ORDER )

15. TOTALDUEANDPAYABLE:

PAYABLE TO

CITY OF MONTROSE

. .

I

SCHEDULE -A:

I

SPECIAL MESSAGE TO CITY

I hereby certJfy under penalty ol pequry that

the

statements

made here are to the best of my

knov.Jedge

true and correct

BY

COMPANY

PHOtiE

TITLE

DATE

PLEASE COMPLETE THIS FORM ON REVERSE SIDE

3.

3.3%

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2