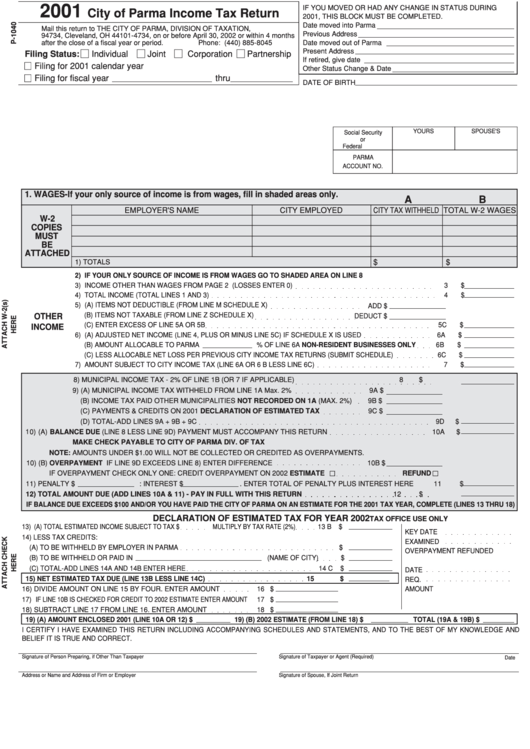

Form P-1040 - City Of Parma Income Tax Return - 2001

ADVERTISEMENT

2001

IF YOU MOVED OR HAD ANY CHANGE IN STATUS DURING

City of Parma Income Tax Return

2001, THIS BLOCK MUST BE COMPLETED.

Date moved into Parma

Mail this return to THE CITY OF PARMA, DIVISION OF TAXATION, P.O. BOX

Previous Address

94734, Cleveland, OH 44101-4734, on or before April 30, 2002 or within 4 months

after the close of a fiscal year or period.

Phone: (440) 885-8045

Date moved out of Parma

Present Address

Filing Status:

Individual

Joint

Corporation

Partnership

If retired, give date

Filing for 2001 calendar year

Other Status Change & Date

Filing for fiscal year

thru

DATE OF BIRTH

YOURS

SPOUSE'S

Social Security

or

Federal I.D. No.

PARMA

ACCOUNT NO.

1. WAGES-If your only source of income is from wages, fill in shaded areas only.

A

B

EMPLOYER'S NAME

CITY EMPLOYED

CITY TAX WITHHELD

TOTAL W-2 WAGES

W-2

COPIES

MUST

BE

ATTACHED

1) TOTALS

$

$

2) IF YOUR ONLY SOURCE OF INCOME IS FROM WAGES GO TO SHADED AREA ON LINE 8

3) INCOME OTHER THAN WAGES FROM PAGE 2 (LOSSES ENTER 0)

3

$

4) TOTAL INCOME (TOTAL LINES 1 AND 3)

4

$

5) (A) ITEMS NOT DEDUCTIBLE (FROM LINE M SCHEDULE X)

ADD $

(B) ITEMS NOT TAXABLE (FROM LINE Z SCHEDULE X)

OTHER

DEDUCT $

(C) ENTER EXCESS OF LINE 5A OR 5B

5C

$

INCOME

6) (A) ADJUSTED NET INCOME (LINE 4, PLUS OR MINUS LINE 5C) IF SCHEDULE X IS USED

6A

$

(B) AMOUNT ALLOCABLE TO PARMA

% OF LINE 6A NON-RESIDENT BUSINESSES ONLY

6B

$

(C) LESS ALLOCABLE NET LOSS PER PREVIOUS CITY INCOME TAX RETURNS (SUBMIT SCHEDULE)

6C

$

7) AMOUNT SUBJECT TO CITY INCOME TAX (LINE 6A OR 6 B LESS LINE 6C)

7

$

8) MUNICIPAL INCOME TAX - 2% OF LINE 1B (OR 7 IF APPLICABLE)

8

$

9) (A) MUNICIPAL INCOME TAX WITHHELD FROM LINE 1A Max. 2%

9A $

(B) INCOME TAX PAID OTHER MUNICIPALITIES NOT RECORDED ON 1A (MAX. 2%)

9B $

(C) PAYMENTS & CREDITS ON 2001 DECLARATION OF ESTIMATED TAX

9C $

(D) TOTAL-ADD LINES 9A + 9B + 9C

9D

$

10) (A) BALANCE DUE (LINE 8 LESS LINE 9D) PAYMENT MUST ACCOMPANY THIS RETURN

10A

$

MAKE CHECK PAYABLE TO CITY OF PARMA DIV. OF TAX

NOTE: AMOUNTS UNDER $1.00 WILL NOT BE COLLECTED OR CREDITED AS OVERPAYMENTS.

10) (B) OVERPAYMENT IF LINE 9D EXCEEDS LINE 8) ENTER DIFFERENCE

10B $

IF OVERPAYMENT CHECK ONLY ONE: CREDIT OVERPAYMENT ON 2002 ESTIMATE

REFUND

11) PENALTY $

: INTEREST $

. ENTER TOTAL OF PENALTY PLUS INTEREST HERE

11

$

12) TOTAL AMOUNT DUE (ADD LINES 10A & 11) - PAY IN FULL WITH THIS RETURN

12

$

IF BALANCE DUE EXCEEDS $100 AND/OR YOU HAVE PAID THE CITY OF PARMA ON AN ESTIMATE FOR THE 2001 TAX YEAR, COMPLETE (LINES 13 THRU 18)

DECLARATION OF ESTIMATED TAX FOR YEAR 2002

TAX OFFICE USE ONLY

13) (A) TOTAL ESTIMATED INCOME SUBJECT TO TAX $

MULTIPLY BY TAX RATE (2%)

13 B $

KEY DATE

14) LESS TAX CREDITS:

EXAMINED

(A) TO BE WITHHELD BY EMPLOYER IN PARMA

$

OVERPAYMENT REFUNDED

(B) TO BE WITHHELD OR PAID IN

(NAME OF CITY)

$

(C) TOTAL-ADD LINES 14A AND 14B ENTER HERE

14 C $

DATE

15) NET ESTIMATED TAX DUE (LINE 13B LESS LINE 14C)

15

$

REQ.

16) DIVIDE AMOUNT ON LINE 15 BY FOUR. ENTER AMOUNT

16 $

AMOUNT

17) IF LINE 10B IS CHECKED FOR CREDIT TO 2002 ESTIMATE ENTER AMOUNT

17 $

18) SUBTRACT LINE 17 FROM LINE 16. ENTER AMOUNT

18 $

19) (A) AMOUNT ENCLOSED 2001 (LINE 10A OR 12) $

19) (B) 2002 ESTIMATE (FROM LINE 18) $

TOTAL (19A & 19B) $

I CERTIFY I HAVE EXAMINED THIS RETURN INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS, AND TO THE BEST OF MY KNOWLEDGE AND

BELIEF IT IS TRUE AND CORRECT.

Signature of Person Preparing, if Other Than Taxpayer

Signature of Taxpayer or Agent (Required)

Date

Address or Name and Address of Firm or Employer

Signature of Spouse, If Joint Return

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2