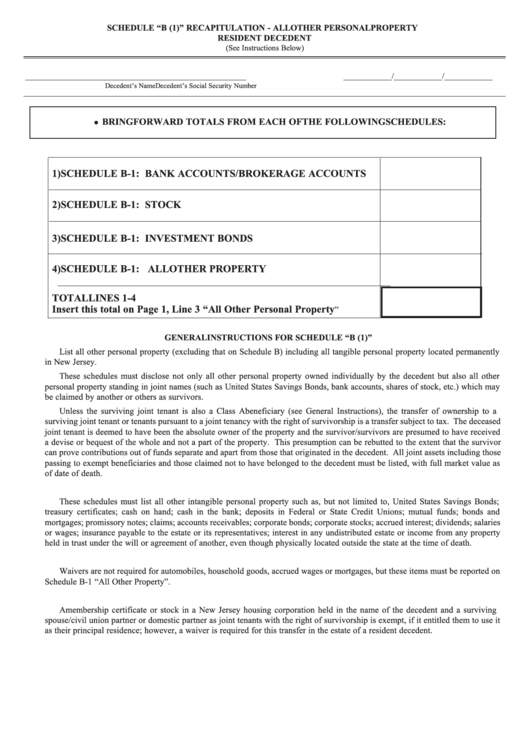

SCHEDULE “B (1)” RECAPITULATION - ALL OTHER PERSONAL PROPERTY

RESIDENT DECEDENT

(See Instructions Below)

_______________________________________________________

____________/____________/____________

Decedent’s Name

Decedent’s Social Security Number

BRING FORWARD TOTALS FROM EACH OF THE FOLLOWING SCHEDULES:

1) SCHEDULE B-1: BANK ACCOUNTS/BROKERAGE ACCOUNTS

2) SCHEDULE B-1: STOCK

3) SCHEDULE B-1: INVESTMENT BONDS

4) SCHEDULE B-1: ALL OTHER PROPERTY

TOTAL LINES 1-4

Insert this total on Page 1, Line 3 “All Other Personal Property

”

GENERAL INSTRUCTIONS FOR SCHEDULE “B (1)”

List all other personal property (excluding that on Schedule B) including all tangible personal property located permanently

in New Jersey.

These schedules must disclose not only all other personal property owned individually by the decedent but also all other

personal property standing in joint names (such as United States Savings Bonds, bank accounts, shares of stock, etc.) which may

be claimed by another or others as survivors.

Unless the surviving joint tenant is also a Class A beneficiary (see General Instructions), the transfer of ownership to a

surviving joint tenant or tenants pursuant to a joint tenancy with the right of survivorship is a transfer subject to tax. The deceased

joint tenant is deemed to have been the absolute owner of the property and the survivor/survivors are presumed to have received

a devise or bequest of the whole and not a part of the property. This presumption can be rebutted to the extent that the survivor

can prove contributions out of funds separate and apart from those that originated in the decedent. All joint assets including those

passing to exempt beneficiaries and those claimed not to have belonged to the decedent must be listed, with full market value as

of date of death.

These schedules must list all other intangible personal property such as, but not limited to, United States Savings Bonds;

treasury certificates; cash on hand; cash in the bank; deposits in Federal or State Credit Unions; mutual funds; bonds and

mortgages; promissory notes; claims; accounts receivables; corporate bonds; corporate stocks; accrued interest; dividends; salaries

or wages; insurance payable to the estate or its representatives; interest in any undistributed estate or income from any property

held in trust under the will or agreement of another, even though physically located outside the state at the time of death.

Waivers are not required for automobiles, household goods, accrued wages or mortgages, but these items must be reported on

Schedule B-1 “All Other Property”.

A membership certificate or stock in a New Jersey housing corporation held in the name of the decedent and a surviving

spouse/civil union partner or domestic partner as joint tenants with the right of survivorship is exempt, if it entitled them to use it

as their principal residence; however, a waiver is required for this transfer in the estate of a resident decedent.

1

1 2

2 3

3 4

4 5

5