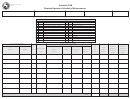

Form Sf# 49091 - Schedule 501b Terminal Operator'S Schedule Of Disbursements 2007 Page 2

ADVERTISEMENT

Instructions for Completing

Terminal Operator’s Schedule of Disbursements

Schedule 501B

Before You Begin:

Enter your identifying information as it is refl ected on your Indiana Fuel Tax License.

(Be certain to complete a separate schedule for each fuel product type that you circle.)

.

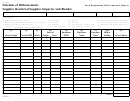

Column Instructions:

Columns 1 and 2: Enter the name and Federal Employer’s Identifi cation Number (FEIN) of the company that

transports the fuel. This may be you.

Column 3: Enter the mode of transport: One of the following codes should be used for each entry.

J

= Truck

S

= Ship (Great Lakes or Ocean Vessel)

R

= Rail

ST = Stock Transfer

B

= Barge

BA = Book Adjustment

PL = Pipeline

Column 4: Enter the destination state to which the fuel was transported.

Columns 5, 6, 7 and 8: Enter the position holder’s information as well as the shipping document date and

number.

The Position Holder is the person who owns/leases storage space in the terminal.

Column 9: Enter the net gallons received. The grand total of all Schedule-501B, Column 9, should be carried

to the FT-501, Terminal Operator’s Monthly Return.

For product types 142, 160, 161, 167, 170, 171, 228, BOO or DOO, carry this total to Line 3, Column A of the

FT-501.

For product types 065, 124, EOO, E85 and MOO, carry this total to Line 3, Column B of the FT-501.

For product type 142, 130, 150, 161 or 231, carry this total to Line 3, Column C of the FT-501

.

Note: You must subtotal by position holder on the Schedule-501B and carry these subtotals to Schedule 501I,

column 5.

Column 10: Enter the gross gallons disbursed.

Columns 11 and 12: Enter the position holders customer name and Federal Employer’s Identifi cation Number

(FEIN).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2