Form L -0740 - Application To Suspend The Filing Of Employer'S Quarterly Contribution Reports

ADVERTISEMENT

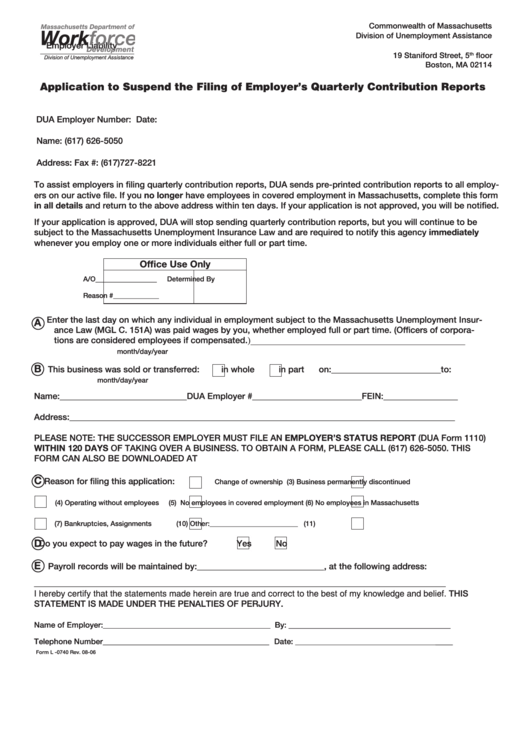

Commonwealth of Massachusetts

Massachusetts Department of

Workforce

Division of Unemployment Assistance

Employer Liability

Development

19 Staniford Street, 5

floor

th

Division of Unemployment Assistance

Boston, MA 02114

Application to Suspend the Filing of Employer’s Quarterly Contribution Reports

DUA Employer Number:

Date:

Name:

(617) 626-5050

Address:

Fax #: (617)727-8221

To assist employers in filing quarterly contribution reports, DUA sends pre-printed contribution reports to all employ-

ers on our active file. If you no longer have employees in covered employment in Massachusetts, complete this form

in all details and return to the above address within ten days. If your application is not approved, you will be notified.

If your application is approved, DUA will stop sending quarterly contribution reports, but you will continue to be

subject to the Massachusetts Unemployment Insurance Law and are required to notify this agency immediately

whenever you employ one or more individuals either full or part time.

Office Use Only

______________

A/O

Determined By

Reason #_____________

Enter the last day on which any individual in employment subject to the Massachusetts Unemployment Insur-

A

ance Law (MGL C. 151A) was paid wages by you, whether employed full or part time. (Officers of corpora-

tions are considered employees if compensated.)_________________________________________________

month/day/year

B

This business was sold or transferred:

in whole

in part

on:_________________________to:

month/day/year

Name:_____________________________DUA Employer #_________________________FEIN:_________________

Address:________________________________________________________________________________________

PLEASE NOTE: THE SUCCESSOR EMPLOYER MUST FILE AN EMPLOYER’S STATUS REPORT (DUA Form 1110)

WITHIN 120 DAYS OF TAKING OVER A BUSINESS. TO OBTAIN A FORM, PLEASE CALL (617) 626-5050. THIS

FORM CAN ALSO BE DOwNLOADED AT

C

Reason for filing this application:

Change of ownership

(3) Business permanently discontinued

(4) Operating without employees

(5) No employees in covered employment

(6) No employees in Massachusetts

(7) Bankruptcies, Assignments

(10) Other:_________________________

(11)

D

Do you expect to pay wages in the future?

Yes

No

E

Payroll records will be maintained by:_____________________________, at the following address:

______________________________________________________________________________________________

I hereby certify that the statements made herein are true and correct to the best of my knowledge and belief. THIS

STATEMENT IS MADE UNDER THE PENALTIES OF PERJURY.

_____________________________________

Name of Employer:___________________________________________ By:

______________________________________

____

Telephone Number

Date: ____________________________________

Form L -0740 Rev. 08-06

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1