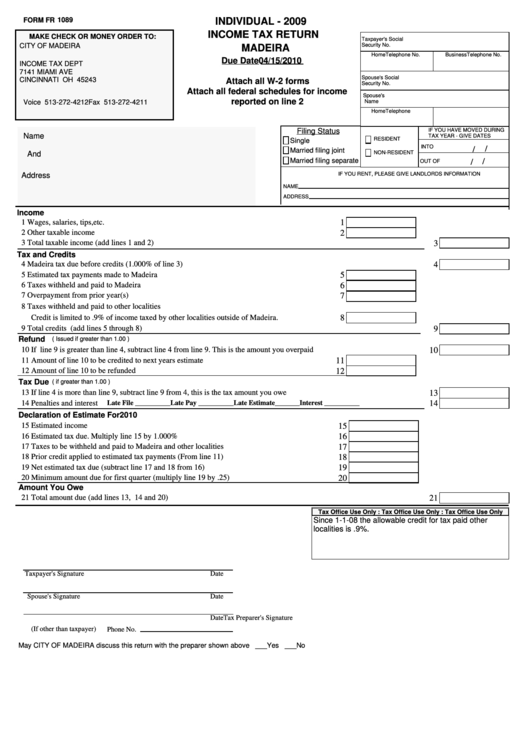

Form Fr 1089 - Individual Income Tax Return - Madeira - 2009

ADVERTISEMENT

FORM FR

1089

INDIVIDUAL - 2009

INCOME TAX RETURN

MAKE CHECK OR MONEY ORDER TO:

Taxpayer's Social

CITY OF MADEIRA

Security No.

MADEIRA

HomeTelephone No.

BusinessTelephone No.

Due Date 04/15/2010

INCOME TAX DEPT

7141 MIAMI AVE

Spouse's Social

CINCINNATI OH 45243

Attach all W-2 forms

Security No.

Attach all federal schedules for income

Spouse's

reported on line 2

Name

Voice 513-272-4212 Fax 513-272-4211

HomeTelephone No.

BusinessTelephone No.

Filing Status

IF YOU HAVE MOVED DURING

Name

TAX YEAR - GIVE DATES

RESIDENT

Single

INTO

/

/

Married filing joint

NON-RESIDENT

And

Married filing separate

/

OUT OF

/

IF YOU RENT, PLEASE GIVE LANDLORDS INFORMATION

Address

NAME

ADDRESS

Income

1 Wages, salaries, tips,etc.

1

2 Other taxable income

2

3 Total taxable income (add lines 1 and 2)

3

Tax and Credits

4 Madeira tax due before credits (1.000% of line 3)

4

5 Estimated tax payments made to Madeira

5

6 Taxes withheld and paid to Madeira

6

7 Overpayment from prior year(s)

7

8 Taxes withheld and paid to other localities

Credit is limited to .9% of income taxed by other localities outside of Madeira.

8

9 Total credits (add lines 5 through 8)

9

Refund

( Issued if greater than 1.00 )

10 If line 9 is greater than line 4, subtract line 4 from line 9. This is the amount you overpaid

10

11 Amount of line 10 to be credited to next years estimate

11

12 Amount of line 10 to be refunded

12

Tax Due

( if greater than 1.00 )

13 If line 4 is more than line 9, subtract line 9 from 4, this is the tax amount you owe

13

14 Penalties and interest

Late File __________

Late Pay __________

Late Estimate_______

Interest __________

14

Declaration of Estimate For 2010

15 Estimated income

15

16 Estimated tax due. Multiply line 15 by 1.000%

16

17 Taxes to be withheld and paid to Madeira and other localities

17

18 Prior credit applied to estimated tax payments (From line 11)

18

19 Net estimated tax due (subtract line 17 and 18 from 16)

19

20 Minimum amount due for first quarter (multiply line 19 by .25)

20

Amount You Owe

21 Total amount due (add lines 13, 14 and 20)

21

Tax Office Use Only : Tax Office Use Only : Tax Office Use Only

Since 1-1-08 the allowable credit for tax paid other

localities is .9%.

Taxpayer's Signature

Date

Spouse's Signature

Date

Tax Preparer's Signature

Date

(If other than taxpayer)

Phone No.

May CITY OF MADEIRA discuss this return with the preparer shown above ___Yes ___No

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1