Credit Ratio Worksheet For An Owner Of A Sole Proprietorship Or A Member Of A Pass-Through Entity Claiming The Pine Tree Development Zone Income Tax Credit

ADVERTISEMENT

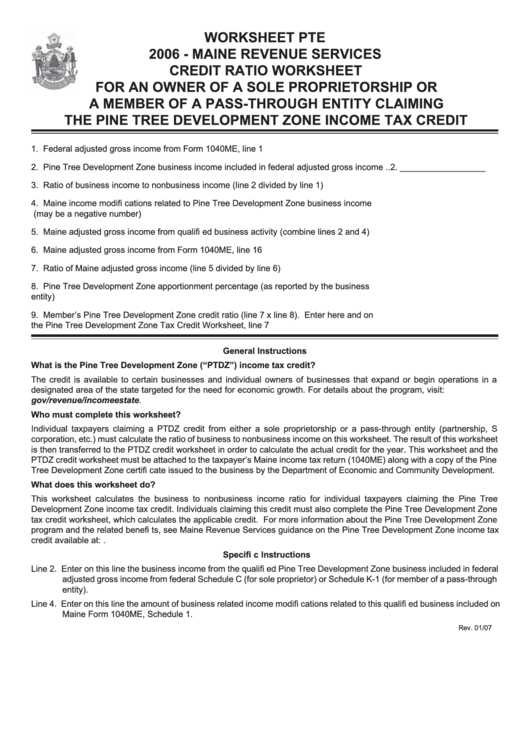

WORKSHEET PTE

2006 - MAINE REVENUE SERVICES

CREDIT RATIO WORKSHEET

FOR AN OWNER OF A SOLE PROPRIETORSHIP OR

A MEMBER OF A PASS-THROUGH ENTITY CLAIMING

THE PINE TREE DEVELOPMENT ZONE INCOME TAX CREDIT

1.

Federal adjusted gross income from Form 1040ME, line 1 .................................................... 1. __________________

2.

Pine Tree Development Zone business income included in federal adjusted gross income .. 2. __________________

3.

Ratio of business income to nonbusiness income (line 2 divided by line 1) ........................... 3. __________________

4.

Maine income modifi cations related to Pine Tree Development Zone business income

(may be a negative number) ................................................................................................... 4. __________________

5.

Maine adjusted gross income from qualifi ed business activity (combine lines 2 and 4) ......... 5. __________________

6.

Maine adjusted gross income from Form 1040ME, line 16 .................................................... 6. __________________

7.

Ratio of Maine adjusted gross income (line 5 divided by line 6) ............................................. 7. __________________

8.

Pine Tree Development Zone apportionment percentage (as reported by the business

entity) ...................................................................................................................................... 8. __________________

9.

Member’s Pine Tree Development Zone credit ratio (line 7 x line 8). Enter here and on

the Pine Tree Development Zone Tax Credit Worksheet, line 7 ............................................. 9. __________________

General Instructions

What is the Pine Tree Development Zone (“PTDZ”) income tax credit?

The credit is available to certain businesses and individual owners of businesses that expand or begin operations in a

designated area of the state targeted for the need for economic growth. For details about the program, visit:

gov/revenue/incomeestate.

Who must complete this worksheet?

Individual taxpayers claiming a PTDZ credit from either a sole proprietorship or a pass-through entity (partnership, S

corporation, etc.) must calculate the ratio of business to nonbusiness income on this worksheet. The result of this worksheet

is then transferred to the PTDZ credit worksheet in order to calculate the actual credit for the year. This worksheet and the

PTDZ credit worksheet must be attached to the taxpayer’s Maine income tax return (1040ME) along with a copy of the Pine

Tree Development Zone certifi cate issued to the business by the Department of Economic and Community Development.

What does this worksheet do?

This worksheet calculates the business to nonbusiness income ratio for individual taxpayers claiming the Pine Tree

Development Zone income tax credit. Individuals claiming this credit must also complete the Pine Tree Development Zone

tax credit worksheet, which calculates the applicable credit. For more information about the Pine Tree Development Zone

program and the related benefi ts, see Maine Revenue Services guidance on the Pine Tree Development Zone income tax

credit available at: gov/revenue/incomeestate.

Specifi c Instructions

Line 2. Enter on this line the business income from the qualifi ed Pine Tree Development Zone business included in federal

adjusted gross income from federal Schedule C (for sole proprietor) or Schedule K-1 (for member of a pass-through

entity).

Line 4. Enter on this line the amount of business related income modifi cations related to this qualifi ed business included on

Maine Form 1040ME, Schedule 1.

Rev. 01/07

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1