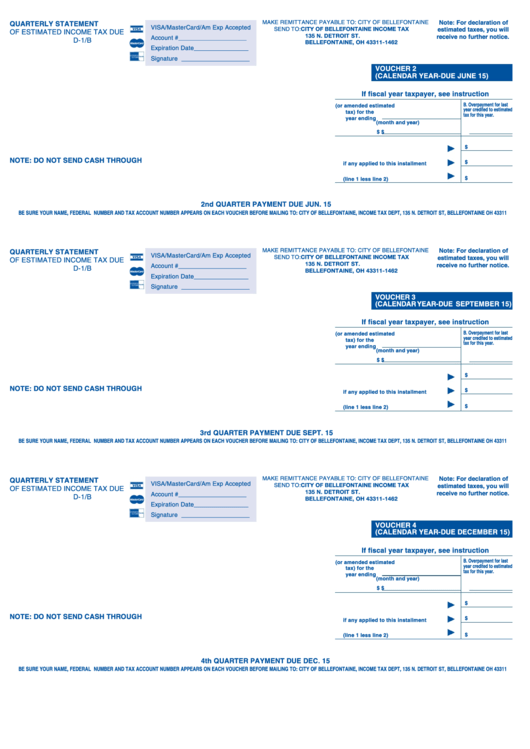

Quarterly Statement Of Estimated Income Tax Form

ADVERTISEMENT

MAKE REMITTANCE PAYABLE TO: CITY OF BELLEFONTAINE

Note: For declaration of

QUARTERLY STATEMENT

VISA/MasterCard/Am Exp Accepted

SEND TO: CITY OF BELLEFONTAINE INCOME TAX

estimated taxes, you will

OF ESTIMATED INCOME TAX DUE

135 N. DETROIT ST.

receive no further notice.

Account # ____________________

D-1/B

BELLEFONTAINE, OH 43311-1462

Expiration Date ________________

Signature ____________________

VOUCHER 2

(CALENDAR YEAR-DUE JUNE 15)

If fiscal year taxpayer, see instruction

B. Overpayment for last

A. Estimated tax (or amended estimated

year credited to estimated

tax) for the

tax for this year.

year ending

(month and year)

$

$

$

1. Amount of this installment .....................

2. Amount of unused overpayment credit

NOTE: DO NOT SEND CASH THROUGH U.S. MAIL

$

if any applied to this installment ...........

3. Amount of this installment payment

$

(line 1 less line 2) ....................................

2nd QUARTER PAYMENT DUE JUN. 15

BE SURE YOUR NAME, FEDERAL I.D. NUMBER AND TAX ACCOUNT NUMBER APPEARS ON EACH VOUCHER BEFORE MAILING TO: CITY OF BELLEFONTAINE, INCOME TAX DEPT, 135 N. DETROIT ST, BELLEFONTAINE OH 43311

MAKE REMITTANCE PAYABLE TO: CITY OF BELLEFONTAINE

Note: For declaration of

QUARTERLY STATEMENT

VISA/MasterCard/Am Exp Accepted

SEND TO: CITY OF BELLEFONTAINE INCOME TAX

estimated taxes, you will

OF ESTIMATED INCOME TAX DUE

135 N. DETROIT ST.

receive no further notice.

Account # ____________________

D-1/B

BELLEFONTAINE, OH 43311-1462

Expiration Date ________________

Signature ____________________

VOUCHER 3

(CALENDAR YEAR-DUE SEPTEMBER 15)

If fiscal year taxpayer, see instruction

B. Overpayment for last

A. Estimated tax (or amended estimated

year credited to estimated

tax) for the

tax for this year.

year ending

(month and year)

$

$

$

1. Amount of this installment .....................

2. Amount of unused overpayment credit

NOTE: DO NOT SEND CASH THROUGH U.S. MAIL

$

if any applied to this installment ...........

3. Amount of this installment payment

$

(line 1 less line 2) ....................................

3rd QUARTER PAYMENT DUE SEPT. 15

BE SURE YOUR NAME, FEDERAL I.D. NUMBER AND TAX ACCOUNT NUMBER APPEARS ON EACH VOUCHER BEFORE MAILING TO: CITY OF BELLEFONTAINE, INCOME TAX DEPT, 135 N. DETROIT ST, BELLEFONTAINE OH 43311

MAKE REMITTANCE PAYABLE TO: CITY OF BELLEFONTAINE

Note: For declaration of

QUARTERLY STATEMENT

VISA/MasterCard/Am Exp Accepted

SEND TO: CITY OF BELLEFONTAINE INCOME TAX

estimated taxes, you will

OF ESTIMATED INCOME TAX DUE

135 N. DETROIT ST.

receive no further notice.

Account # ____________________

D-1/B

BELLEFONTAINE, OH 43311-1462

Expiration Date ________________

Signature ____________________

VOUCHER 4

(CALENDAR YEAR-DUE DECEMBER 15)

If fiscal year taxpayer, see instruction

B. Overpayment for last

A. Estimated tax (or amended estimated

year credited to estimated

tax) for the

tax for this year.

year ending

(month and year)

$

$

$

1. Amount of this installment .....................

2. Amount of unused overpayment credit

NOTE: DO NOT SEND CASH THROUGH U.S. MAIL

$

if any applied to this installment ...........

3. Amount of this installment payment

$

(line 1 less line 2) ....................................

4th QUARTER PAYMENT DUE DEC. 15

BE SURE YOUR NAME, FEDERAL I.D. NUMBER AND TAX ACCOUNT NUMBER APPEARS ON EACH VOUCHER BEFORE MAILING TO: CITY OF BELLEFONTAINE, INCOME TAX DEPT, 135 N. DETROIT ST, BELLEFONTAINE OH 43311

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5