Form Ir - Income Tax Return For 2007

ADVERTISEMENT

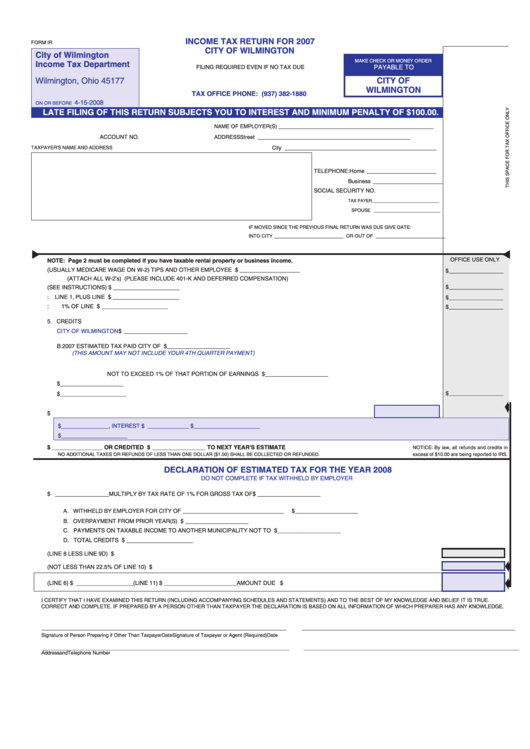

INCOME TAX RETURN FOR 2007

FORM IR

CITY OF WILMINGTON

City of Wilmington

MAKE CHECK OR MONEY ORDER

Income Tax Department

PAYABLE TO

FILING REQUIRED EVEN IF NO TAX DUE

P.O. Box 786

Wilmington, Ohio 45177

CITY OF

WILMINGTON

TAX OFFICE PHONE: (937) 382-1880

4-15-2008

ON OR BEFORE

LATE FILING OF THIS RETURN SUBJECTS YOU TO INTEREST AND MINIMUM PENALTY OF $100.00.

NAME OF EMPLOYER(S) _____________________________________________________

ACCOUNT NO.

ADDRESS

Street ____________________________________________________

TAXPAYER'S NAME AND ADDRESS

City ____________________________________________________

TELEPHONE:

Home ______________________

Business ______________________

SOCIAL SECURITY NO.

TAX PAYER _____________________________

SPOUSE __________________________

IF MOVED SINCE THE PREVIOUS FINAL RETURN WAS DUE GIVE DATE:

INTO CITY __________________________ OR OUT OF __________________________

OFFICE USE ONLY

NOTE: Page 2 must be completed if you have taxable rental property or business income.

1. QUALIFYING WAGES (USUALLY MEDICARE WAGE ON W-2) TIPS AND OTHER EMPLOYEE COMPENSATION .............$ ___________________

$ __________________

(ATTACH ALL W-2's) (PLEASE INCLUDE 401-K AND DEFERRED COMPENSATION)

2. OTHER TAXABLE INCOME (SEE INSTRUCTIONS) .................................................................................................................$ _____________________

$ __________________

3. TAXABLE INCOME:

LINE 1, PLUS LINE 2..............................................................................................................................$ _____________________

$ __________________

4. MUNICIPAL TAX:

1% OF LINE 3 .........................................................................................................................................$ _____________________

$ __________________

5. CREDITS

A. TAX WITHHELD BY EMPLOYER FOR

CITY OF WILMINGTON

................................................$ ____________________

B. 2007 ESTIMATED TAX PAID CITY OF WILMINGTON................................................................$ ____________________

(THIS AMOUNT MAY NOT INCLUDE YOUR 4TH QUARTER PAYMENT)

C. TAX PAID CITY OF ________________________

NOT TO EXCEED 1% OF THAT PORTION OF EARNINGS TAXED.................$ ____________________

D. PRIOR YEAR OVER PAYMENTS................................................................................................$ ____________________

$ __________________

E. TOTAL CREDITS.................................................................................................................................................................. $_____________________

6.

IF LINE 4 GREATER THAN LINE 5E PAYMENT OF BALANCE MUST ACCOMPANY THIS RETURN

TAX DUE ............ $

A. PENALTY $_______________, INTEREST $ _____________

........................................................................TOTAL $ _____________________

B. TOTAL AMOUNT DUE ....................................................................................................................................................... $ _____________________

7.

OVERPAYMENT TO BE REFUNDED $ ________________ OR CREDITED $ _________________ TO NEXT YEAR'S ESTIMATE

NOTICE: By law, all refunds and credits in

NO ADDITIONAL TAXES OR REFUNDS OF LESS THAN ONE DOLLAR ($1.00) SHALL BE COLLECTED OR REFUNDED.

excess of $10.00 are being reported to IRS.

DECLARATION OF ESTIMATED TAX FOR THE YEAR 2008

DO NOT COMPLETE IF TAX WITHHELD BY EMPLOYER

8.

TOTAL INCOME SUBJECT TO TAX $ _________________

MULTIPLY BY TAX RATE OF 1% FOR GROSS TAX OF

$ ____________________

9.

LESS EXPECTED TAX CREDITS

A. WITHHELD BY EMPLOYER FOR CITY OF ________________________________

................................................... $ ____________________

B. OVERPAYMENT FROM PRIOR YEAR(S) ........................................................................................................................... $ ____________________

C. PAYMENTS ON TAXABLE INCOME TO ANOTHER MUNICIPALITY NOT TO EXCEED................................................. $ ____________________

D. TOTAL CREDITS ....................................................................................................................................................................................................... $ _____________________

10.

NET TAX DUE (LINE 8 LESS LINE 9D) ........................................................................................................................................................................... $

11.

AMOUNT PAID WITH THIS DECLARATION (NOT LESS THAN 22.5% OF LINE 10) .................................................................................................... $

12.

AMOUNT ENCLOSED ________________ (LINE 6) $ __________________

(LINE 11) $ _______________________

AMOUNT DUE $

I CERTIFY THAT I HAVE EXAMINED THIS RETURN (INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS) AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IT IS TRUE.

CORRECT AND COMPLETE. IF PREPARED BY A PERSON OTHER THAN TAXPAYER THE DECLARATION IS BASED ON ALL INFORMATION OF WHICH PREPARER HAS ANY KNOWLEDGE.

____________________________________________________________________________________

_________________________________________________________________________

Signature of Person Preparing if Other Than Taxpayer

Date

Signature of Taxpayer or Agent (Required)

Date

________________________________________________________________________________________

_____________________________________________________________________________

Address

and

Telephone Number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2