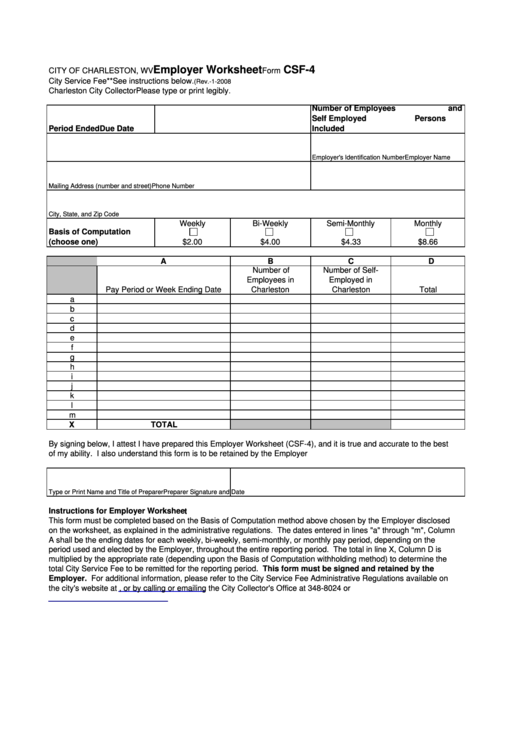

Form Csf-4 - Employer Worksheet - City Of Charleston

ADVERTISEMENT

Employer Worksheet

CSF-4

CITY OF CHARLESTON, WV

Form

City Service Fee

**See instructions below.

(Rev.-1-2008

Charleston City Collector

Please type or print legibly.

Number of Employees

and

Self Employed

Persons

Period Ended

Due Date

Included

Employer Name

Employer's Identification Number

Mailing Address (number and street)

Phone Number

City, State, and Zip Code

Weekly

Bi-Weekly

Semi-Monthly

Monthly

Basis of Computation

(choose one)

$2.00

$4.00

$4.33

$8.66

A

B

C

D

Number of

Number of Self-

Employees in

Employed in

Pay Period or Week Ending Date

Charleston

Charleston

Total

a

b

c

c

d

e

f

g

h

i

j

k

l

m

X

TOTAL

By signing below, I attest I have prepared this Employer Worksheet (CSF-4), and it is true and accurate to the best

of my ability. I also understand this form is to be retained by the Employer

Type or Print Name and Title of Preparer

Preparer Signature and Date

Instructions for Employer Worksheet

This form must be completed based on the Basis of Computation method above chosen by the Employer disclosed

on the worksheet, as explained in the administrative regulations. The dates entered in lines "a" through "m", Column

A shall be the ending dates for each weekly, bi-weekly, semi-monthly, or monthly pay period, depending on the

period used and elected by the Employer, throughout the entire reporting period. The total in line X, Column D is

multiplied by the appropriate rate (depending upon the Basis of Computation withholding method) to determine the

total City Service Fee to be remitted for the reporting period. This form must be signed and retained by the

Employer. For additional information, please refer to the City Service Fee Administrative Regulations available on

the city's website at , or by calling or emailing the City Collector's Office at 348-8024 or

.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1