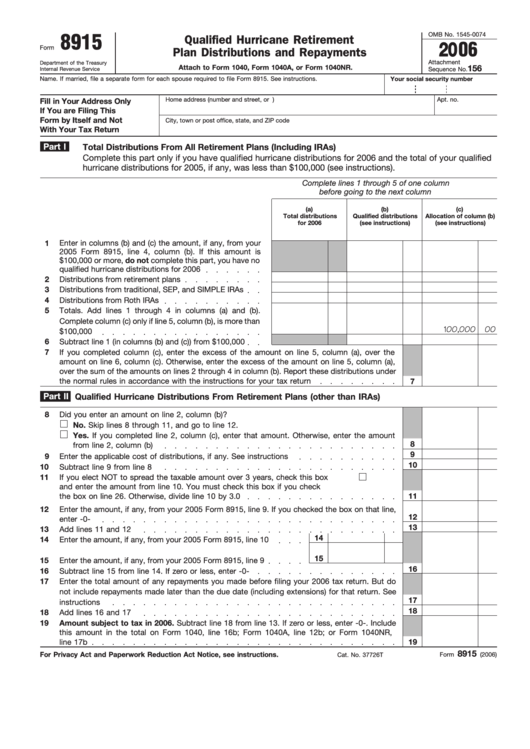

OMB No. 1545-0074

8915

Qualified Hurricane Retirement

2006

Form

Plan Distributions and Repayments

Attachment

Department of the Treasury

Attach to Form 1040, Form 1040A, or Form 1040NR.

156

Sequence No.

Internal Revenue Service

Name. If married, file a separate form for each spouse required to file Form 8915. See instructions.

Your social security number

Home address (number and street, or P.O. box if mail is not delivered to your home)

Apt. no.

Fill in Your Address Only

If You are Filing This

Form by Itself and Not

City, town or post office, state, and ZIP code

With Your Tax Return

Part I

Total Distributions From All Retirement Plans (Including IRAs)

Complete this part only if you have qualified hurricane distributions for 2006 and the total of your qualified

hurricane distributions for 2005, if any, was less than $100,000 (see instructions).

Complete lines 1 through 5 of one column

before going to the next column

(a)

(b)

(c)

Total distributions

Qualified distributions

Allocation of column (b)

for 2006

(see instructions)

(see instructions)

Enter in columns (b) and (c) the amount, if any, from your

1

2005 Form 8915, line 4, column (b). If this amount is

$100,000 or more, do not complete this part, you have no

qualified hurricane distributions for 2006

2

Distributions from retirement plans

3

Distributions from traditional, SEP, and SIMPLE IRAs

4

Distributions from Roth IRAs

5

Totals. Add lines 1 through 4 in columns (a) and (b).

Complete column (c) only if line 5, column (b), is more than

100,000

00

$100,000

6

Subtract line 1 (in columns (b) and (c)) from $100,000

7

If you completed column (c), enter the excess of the amount on line 5, column (a), over the

amount on line 6, column (c). Otherwise, enter the excess of the amount on line 5, column (a),

over the sum of the amounts on lines 2 through 4 in column (b). Report these distributions under

the normal rules in accordance with the instructions for your tax return

7

Part II

Qualified Hurricane Distributions From Retirement Plans (other than IRAs)

8

Did you enter an amount on line 2, column (b)?

No. Skip lines 8 through 11, and go to line 12.

Yes. If you completed line 2, column (c), enter that amount. Otherwise, enter the amount

8

from line 2, column (b)

9

9

Enter the applicable cost of distributions, if any. See instructions

10

10

Subtract line 9 from line 8

11

If you elect NOT to spread the taxable amount over 3 years, check this box

and enter the amount from line 10. You must check this box if you check

11

the box on line 26. Otherwise, divide line 10 by 3.0

12

Enter the amount, if any, from your 2005 Form 8915, line 9. If you checked the box on that line,

12

enter -0-

13

13

Add lines 11 and 12

14

14

Enter the amount, if any, from your 2005 Form 8915, line 10

15

15

Enter the amount, if any, from your 2005 Form 8915, line 9

16

16

Subtract line 15 from line 14. If zero or less, enter -0-

17

Enter the total amount of any repayments you made before filing your 2006 tax return. But do

not include repayments made later than the due date (including extensions) for that return. See

17

instructions

18

18

Add lines 16 and 17

19

Amount subject to tax in 2006. Subtract line 18 from line 13. If zero or less, enter -0-. Include

this amount in the total on Form 1040, line 16b; Form 1040A, line 12b; or Form 1040NR,

line 17b

19

8915

For Privacy Act and Paperwork Reduction Act Notice, see instructions.

Cat. No. 37726T

Form

(2006)

1

1 2

2