Form Pit-X - New Mexico Personal Income Tax 2006

ADVERTISEMENT

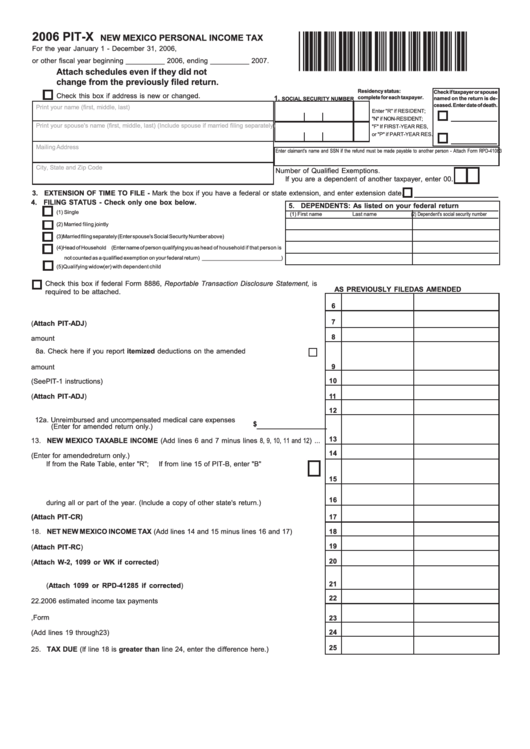

2006 PIT-X

*60160200*

NEW MEXICO PERSONAL INCOME TAX

For the year January 1 - December 31, 2006,

or other fiscal year beginning __________ 2006, ending __________ 2007.

Attach schedules even if they did not

change from the previously filed return.

Residency status:

Check if taxpayer or spouse

Check this box if address is new or changed.

1.

complete for each taxpayer.

named on the return is de-

SOCIAL SECURITY NUMBER

ceased. Enter date of death.

Print your name (first, middle, last)

Enter "R" if RESIDENT;

"N" if NON-RESIDENT;

Print your spouse's name (first, middle, last) (Include spouse if married filing separately)

"F" If FIRST-YEAR RES,

or "P" if PART-YEAR RES.

Mailing Address

Enter claimant's name and SSN if the refund must be made payable to another person - Attach Form RPD-41083

City, State and Zip Code

2. EXEMPTIONS Number of Qualified Exemptions.

If you are a dependent of another taxpayer, enter 00.

3. EXTENSION OF TIME TO FILE - Mark the box if you have a federal or state extension, and enter extension date.

4.

FILING STATUS - Check only one box below.

5.

DEPENDENTS: As listed on your federal return

(1) Single

(2) Dependent's social security number

(1) First name

Last name

(2) Married filing jointly

(3) Married filing separately (Enter spouse's Social Security Number above)

(4) Head of Household (Enter name of person qualifying you as head of household if that person is

not counted as a qualified exemption on your federal return) ____________________________)

(5) Qualifying widow(er) with dependent child

Check this box if federal Form 8886, Reportable Transaction Disclosure Statement, is

AS PREVIOUSLY FILED

AS AMENDED

required to be attached.

6

6.

FEDERAL ADJUSTED GROSS INCOME ........................................................................

7

7.

Additions to federal income (Attach PIT-ADJ) ..................................................................

8

8.

Federal standard or itemized deduction amount ................................................................

8a. Check here if you report itemized deductions on the amended return. ....................

9

9.

Federal exemption amount ..................................................................................................

10

10. New Mexico low- and middle-income tax exemption (See PIT-1 instructions) ..................

11. Deductions/Exemptions from federal income (Attach PIT-ADJ) .......................................

11

12

12. Medical care expense deduction ........................................................................................

12a. Unreimbursed and uncompensated medical care expenses

$

__________________

(Enter for amended return only.) ...................................................

13

13. NEW MEXICO TAXABLE INCOME (Add lines 6 and 7 minus lines 8, 9, 10, 11 and 12) ...

14

14. Tax on amount on line 13. (Enter for amended return only.) .............................................

If from the Rate Table, enter "R";

If from line 15 of PIT-B, enter "B" ......................

15. Additional amount for tax on lump-sum distributions ..........................................................

15

16. Credit for taxes paid to another state. You must have been a New Mexico resident

16

during all or part of the year. (Include a copy of other state's return.) ..............................

17. Non-refundable credits from Schedule PIT-CR (Attach PIT-CR) ......................................

17

18. NET NEW MEXICO INCOME TAX (Add lines 14 and 15 minus lines 16 and 17) ..............

18

19

19. Total claimed on rebate and credit schedule (Attach PIT-RC) .........................................

20

20. New Mexico income tax withheld (Attach W-2, 1099 or WK if corrected) ...................

21. New Mexico income tax withheld from oil and gas proceeds

21

(Attach 1099 or RPD-41285 if corrected) ......................................................................

22

22. 2006 estimated income tax payments .................................................................................

23. Other payments less any refunds from schedule on page 2, Form PIT-X. ........................

23

24

24. Total payments and credits (Add lines 19 through 23) ......................................................

25

25. TAX DUE (If line 18 is greater than line 24, enter the difference here.) ..........................

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2