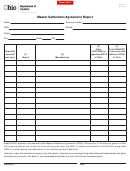

Form Msa 60 - Master Settlement Agreement Report Page 2

ADVERTISEMENT

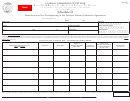

Instructions for Completing Master Settlement Agreement Report

(Form MSA 60)

The state of Ohio is a signatory to the agreement that was

as their filing requirements for the OTP tax return. An MSA

reached between various cigarette manufacturers/importers

60 must be filed regardless of activity.

and the states. This agreement is commonly known as the

Heading – Complete the month or quarter covered by this

Master Settlement Agreement (MSA).

report. The report must start with the first day of the period

Ohio’s participation in the MSA-mandated legislation requires

and end with the last day of the period.

manufacturers who are not signatories to the MSA to pay

into an escrow account a sum roughly equivalent to that which

Column 1 – Cigarette Wholesalers: Report all brands of

is paid by the participating manufacturers. This legislation

NPM cigarettes sold into the state of Ohio on which you affixed

also requires this department to gather information concerning

an Ohio tax stamp. Nonstamping wholesalers do not have to

sales of cigarette and roll-your-own tobacco into Ohio that is

report any cigarette product. The brand name and manufacturer

manufactured/imported by non-participating manufacturers/

must be the same as it appears on the Ohio attorney general’s

importers. This information will be provided to the Ohio

Web site.

attorney general for use in administering the agreement.

OTP Distributors: Report all brands of NPM roll-your-

own tobacco on which you paid the Ohio other tobacco

Schedule of Brands Covered by the MSA

products tax and distributed into the state of Ohio. OTP

A schedule of all brands legal for sale in Ohio can be found

distributors should not report cigarette sales; the cigarette

by going to the attorney general’s Web site. The address is:

wholesaler that applied the tax stamp will report these sales.

The brand name and manufacturer must be the same as it

appears on the Ohio attorney general’s Web site.

This site contains both participating brands and non-

Column 2 – List the product manufacturer for all of the brands

participating brands. Brands that are manufactured by

listed in column 1. The manufacturer name must be the same

participating manufacturers are designated as (PM); brands

as the Ohio attorney general’s Web site to be considered

that are manufactured by non-participating manufacturers are

legal.

designated as (NPM). Only brands with the (NPM)

designation need to be reported on this form. Any brands

Column 3 – Report the number of cartons of cigarettes you

not listed on this site are illegal for sale in the state of Ohio.

stamped with an Ohio tax stamp for each brand reported in

column 1. For purposes of this report, a carton refers to cartons

Master Settlement Agreement Report

containing 200 cigarettes. If you have sold cartons

of other

The Master Settlement Agreement Report (MSA 60) must be

than 200, please indicate such in this column. Only licensed

filed by all stamping cigarette wholesalers and licensed other

cigarette stamping wholesalers should report anything

tobacco products distributors. This report must be filed

in column 3.

monthly or quarterly and is due by the last day of the month

Column 4 – For each brand reported in column 1, report in

following the reporting period.

ounces the quantity of roll-your-own tobacco on which you

Alternate Reports

paid the Ohio OTP tax.

You may elect to design your own reports. Alternate forms

Sign and date the report and return it to:

are permissible as long as all the required information is

Ohio Department of Taxation

provided and is in the same format as this form.

Excise Tax Unit

P. O. Box 530

Required Reporting

Columbus, OH 43216-0530

All stamping cigarette wholesalers must file monthly. Other

If you have any questions, please contact the Ohio Department

tobacco products (OTP) distributors filing status is the same

of Taxation, Excise Tax Section, at (614) 466-7026.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2