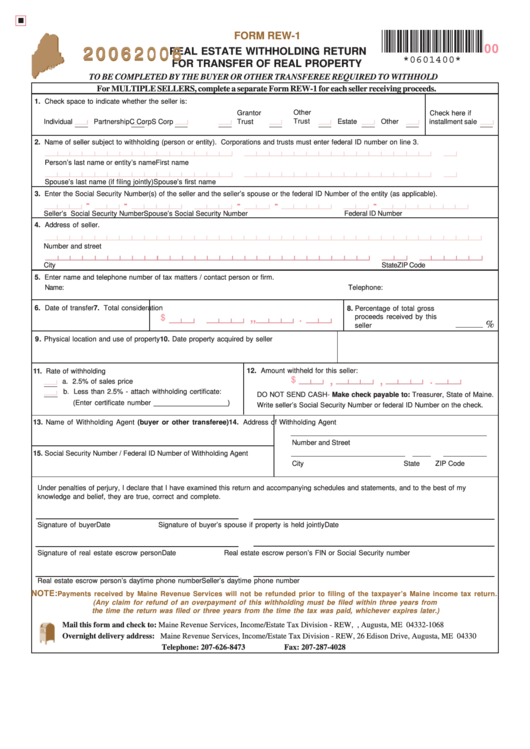

Form Rew-1 - Real Estate Withholding Return For Transfer Of Real Property - 2006

ADVERTISEMENT

FORM REW-1

2006

2006

2006

2006

2006

2006

2006

2006

2006

2006

00

REAL ESTATE WITHHOLDING RETURN

*0601400*

FOR TRANSFER OF REAL PROPERTY

TO BE COMPLETED BY THE BUYER OR OTHER TRANSFEREE REQUIRED TO WITHHOLD

For MULTIPLE SELLERS, complete a separate Form REW-1 for each seller receiving proceeds.

1. Check space to indicate whether the seller is:

Other

Grantor

Check here if

Trust

Individual

Partnership

C Corp

S Corp

Trust

Estate

Other

installment sale

2. Name of seller subject to withholding (person or entity). Corporations and trusts must enter federal ID number on line 3.

Person’s last name or entity’s name

First name

M.I.

Spouse’s last name (if filing jointly)

Spouse’s first name

M.I.

3. Enter the Social Security Number(s) of the seller and the seller’s spouse or the federal ID Number of the entity (as applicable).

-

-

-

-

-

Seller’s Social Security Number

Spouse’s Social Security Number

Federal ID Number

4. Address of seller.

Number and street

City

State

ZIP Code

5. Enter name and telephone number of tax matters / contact person or firm.

Name:

Telephone:

6. Date of transfer

7. Total consideration

8. Percentage of total gross

$

proceeds received by this

,

,

.

%

seller .......................................

9. Physical location and use of property

10. Date property acquired by seller

12. Amount withheld for this seller:

11. Rate of withholding

$

,

,

.

a. 2.5% of sales price

b. Less than 2.5% - attach withholding certificate:

DO NOT SEND CASH - Make check payable to: Treasurer, State of Maine.

(Enter certificate number ___________________)

Write seller’s Social Security Number or federal ID Number on the check.

13. Name of Withholding Agent (buyer or other transferee)

14. Address of Withholding Agent

Number and Street

15. Social Security Number / Federal ID Number of Withholding Agent

City

State

ZIP Code

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my

knowledge and belief, they are true, correct and complete.

Signature of buyer

Date

Signature of buyer’s spouse if property is held jointly

Date

Signature of real estate escrow person

Date

Real estate escrow person’s FIN or Social Security number

Real estate escrow person’s daytime phone number

Seller’s daytime phone number

NOTE:

Payments received by Maine Revenue Services will not be refunded prior to filing of the taxpayer’s Maine income tax return.

(Any claim for refund of an overpayment of this withholding must be filed within three years from

the time the return was filed or three years from the time the tax was paid, whichever expires later.)

Mail this form and check to: Maine Revenue Services, Income/Estate Tax Division - REW, P.O. Box 1068, Augusta, ME 04332-1068

Overnight delivery address: Maine Revenue Services, Income/Estate Tax Division - REW, 26 Edison Drive, Augusta, ME 04330

Telephone: 207-626-8473

Fax: 207-287-4028

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1