Form Fr-128 - Extension Of Time To File Dc Franchise Or Partnership Return 2006

ADVERTISEMENT

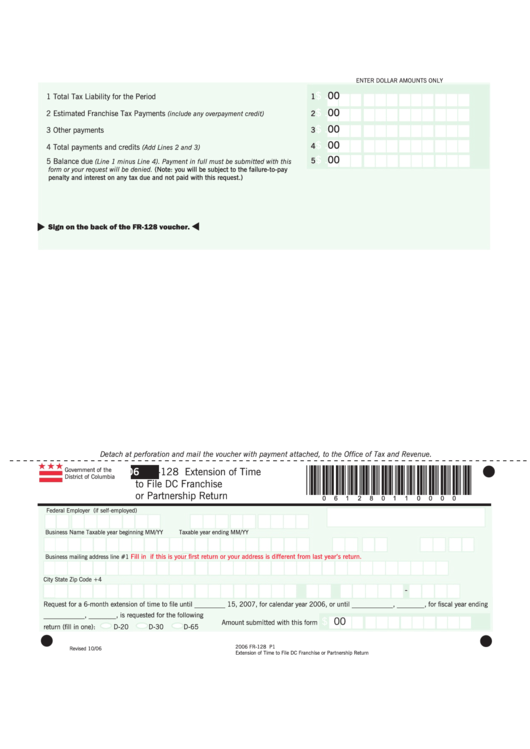

eNter DoLLar amoUNts oNLY

$

.00

1 total tax Liability for the Period

1

$

.00

2 estimated Franchise tax Payments

2

(include any overpayment credit)

$

.00

3

3 other payments

$

.00

4

4 total payments and credits

(Add Lines 2 and 3)

$

.00

5

5 Balance due

(Line 1 minus Line 4). Payment in full must be submitted with this

form or your request will be denied. (Note: you will be subject to the failure-to-pay

penalty and interest on any tax due and not paid with this request.)

Sign on the back of the FR-128 voucher.

Detach at perforation and mail the voucher with payment attached, to the Office of Tax and Revenue.

*061280110000*

government of the

2006

Fr-128 extension of time

District of Columbia

to File DC Franchise

or Partnership return

Federal employer I.D. Number

social security Number (if self-employed)

oFFICIaL Use

Business Name

taxable year beginning mm/YY

taxable year ending mm/YY

Fill in

if this is your first return or your address is different from last year’s return.

Business mailing address line #1

City

state

Zip Code +4

-

request for a 6-month extension of time to file until _________ 15, 2007, for calendar year 2006, or until ____________, ________, for fiscal year ending

____________, ________, is requested for the following

$

.00

amount submitted with this form

return (fill in one):

D-20

D-30

D-65

2006 Fr-128 P1

revised 10/06

extension of time to File DC Franchise or Partnership return

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1