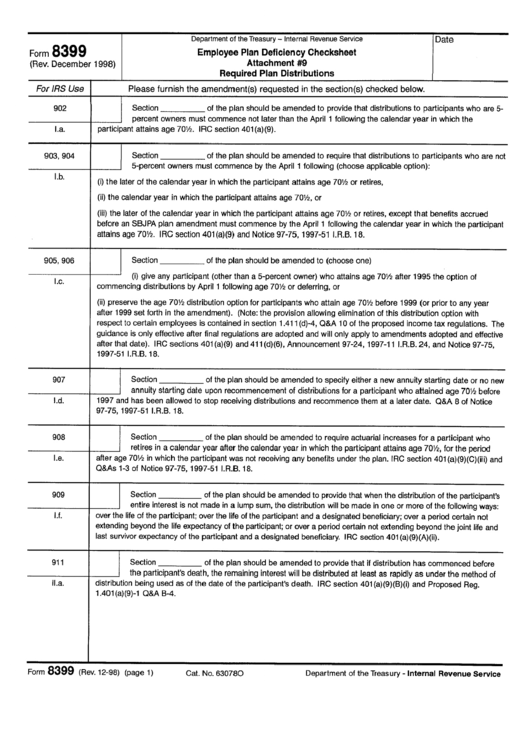

Form 8399 - Employee Plan Deficiency Checksheet Attachment #9 Required Plan Distributions

ADVERTISEMENT

Form 8 3 9 9

(Rev. December 1998)

Department of the Treasury - Internal Revenue Service

Employee Plan Deficiency Checksheet

A t t a c h m e n t #9

Required Plan D i s t r i b u t i o n s

J Date

For IRS Use

9o2

I.a.

903, 904

I.b.

905,906

I.c.

907

I.d.

908

I.e.

9O9

I.f.

911

II.a.

Please furnish the amendment(s) requested in the section(s) checked below.

Section

of the plan should be amended to provide that distributions to participants who are 5-

percent owners must commence not later than the April 1 following the calendar year in which the

participant attains age 701/2. IRC section 401 (a)(9).

Section

of the plan should be amended to require that distributions to participants who are not

5-percent owners must commence by the April 1 following (choose applicable option):

(i) the later of the calendar year in which the participant attains age 701/2 or retires,

(ii) the calendar year in which the participant attains age 701/2, or

(iii) the later of the calendar year in which the participant attains age 701/2 or retires, except that benefits accrued

before an SBJPA plan amendment must commence by the April 1 following the calendar year in which the participant

attains age 701/2. I RC section 401 (a) (9) and Notice 97-75, 1997-51 I.R.B. 18.

Section

of the plan should be amended to (choose one)

(i) give any participant (other than a 5-percent owner) who attains age 701/2 after 1995 the option of

commencing distributions by April 1 following age 701/2 or deferring, or

(ii) preserve the age 701/2 distribution option for participants who attain age 701/2 before 1999 (or prior to any year

after 1999 set forth in the amendment). (Note: the provision allowing elimination of this distribution option with

respect to certain employees is contained in section 1.411 (d)-4, Q&A 10 of the proposed income tax regulations. The

guidance is only effective after final regulations are adopted and will only apply to amendments adopted and effective

after that date). IRC sections 401 (a)(9) and 411 (d)(6), Announcement 97-24, 1997-11 I.R.B. 24, and Notice 97-75,

1997-51 I.R.B. 18.

Section

of the plan should be amended to specify either a new annuity starting date or no new

annuity starting date upon recommencement of distributions for a participant who attained age 701/2 before

1997 and has been allowed to stop receiving distributions and recommence them at a later date. Q&A 8 of Notice

97-75, 1997-51 I.R.B. 18.

Section

of the plan should be amended to require actuarial increases for a participant who

retires in a calendar year after the calendar year in which the participant attains age 701/2, for the period

after age 701/2 in which the participant was not receiving any benefits under the plan. IRC section 401(a)(9)(C)(iii) and

Q&As 1-3 of Notice 97-75, 1997-51 I.R.B. 18.

Section

of the plan should be amended to provide that when the distribution of the participant's

entire interest is not made in a lump sum, the distribution will be made in one or more of the following ways:

over the life of the participant; over the life of the participant and a designated beneficiary; over a period certain not

extending beyond the life expectancy of the participant; or over a period certain not extending beyond the joint life and

last survivor expectancy of the participant and a designated beneficiary. IRC section 401 (a)(9)(A)(ii).

the participant's death, the remaining interest will be distributed at least as rapidly as under the method of

Section

of the plan should be amended to provide that if distribution has commenced before

distribution being used as of the date of the participant's death. IRC section 401(a)(9)(B)(i) and Proposed Reg.

1.401(a)(9)-1 Q&A B-4.

Form

8399

(Rev. 12-98) (page 1)

Cat. No. 630780

Department of the Treasury - Internal

Revenue Service

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2