City Of Wooster, Ohio Quarterly Statement Of Estimated Tax Declared Form

ADVERTISEMENT

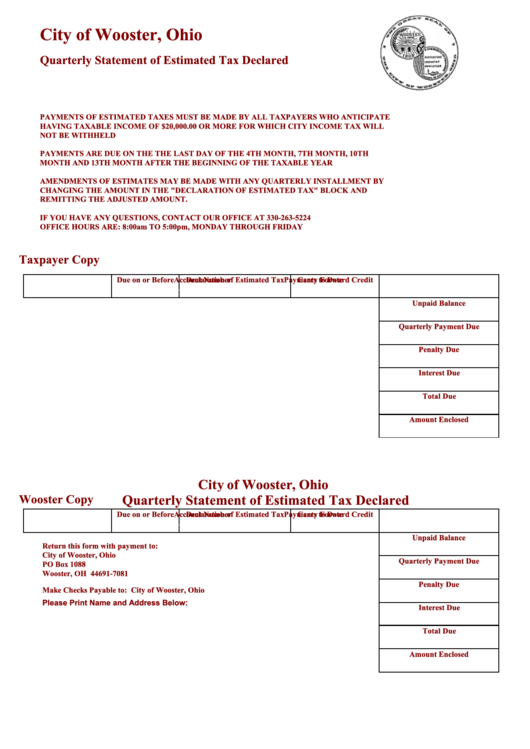

City of Wooster, Ohio

Quarterly Statement of Estimated Tax Declared

PAYMENTS OF ESTIMATED TAXES MUST BE MADE BY ALL TAXPAYERS WHO ANTICIPATE

HAVING TAXABLE INCOME OF $20,000.00 OR MORE FOR WHICH CITY INCOME TAX WILL

NOT BE WITHHELD

PAYMENTS ARE DUE ON THE THE LAST DAY OF THE 4TH MONTH, 7TH MONTH, 10TH

MONTH AND 13TH MONTH AFTER THE BEGINNING OF THE TAXABLE YEAR

AMENDMENTS OF ESTIMATES MAY BE MADE WITH ANY QUARTERLY INSTALLMENT BY

CHANGING THE AMOUNT IN THE "DECLARATION OF ESTIMATED TAX" BLOCK AND

REMITTING THE ADJUSTED AMOUNT.

IF YOU HAVE ANY QUESTIONS, CONTACT OUR OFFICE AT 330-263-5224

OFFICE HOURS ARE: 8:00am TO 5:00pm, MONDAY THROUGH FRIDAY

#Name?

Taxpayer Copy

Account Number

Due on or Before

Declaration of Estimated Tax

Carry Forward Credit

Payments to Date

#Name?

#Name?

#Name?

#Name?

#Name?

Unpaid Balance

#Name?

Quarterly Payment Due

#Name?

#Na Name?

-

Penalty Due

#Name?

#Name?

#Name?

Interest Due

#Name?

#Name?

#Name?

Total Due

#Name?

#Name?

Amount Enclosed

City of Wooster, Ohio

Wooster Copy

Quarterly Statement of Estimated Tax Declared

Account Number

Due on or Before

Declaration of Estimated Tax

Carry Forward Credit

Payments to Date

#Name?

#Name?

#Name?

#Name?

#Name?

Unpaid Balance

Return this form with payment to:

#Name?

City of Wooster, Ohio

Quarterly Payment Due

PO Box 1088

#Name?

Wooster, OH 44691-7081

#Na Name?

-

Penalty Due

Make Checks Payable to: City of Wooster, Ohio

#Name?

Please Print Name and Address Below:

Interest Due

#Name?

#Name?

Total Due

#Name?

#Name?

#Name?

Amount Enclosed

#Name?

#Name?

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1