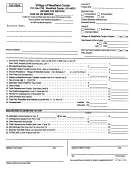

Income Tax Return Form - State Of Ohio Page 2

ADVERTISEMENT

;SCHEDULE*; RECONCILIATION WITH FEDERAL INCOME TAX RETURN

page 2

ITEMS NOT DEDUCTIBLE

a. Capital Losses

$

b. 5% of Lines O, P, and Q

c. Taxes based on Income

d. Excess Charitable Contributions

. . ' . . . .

e. Payments to Partners not already included

in taxable income

f.

Other Items Not Deductible (Explain):

g. Total Additions

$

ADD

ITEMS NOT TAXABLE

n. Capital Gains

•

$

o.

Interest

p. Dividends

q. Royalties and Other Intangibles

r. Other Items Not Taxable (Explain):

s. Total Deductions

$

t

Net Adjustments (Enteron Page 1, line 2) $

DEDUCT

-SCHEDUCEY: BUSINESS ALLOCATION FORMULA

STEP1. Average Value of Real andTangible Property • •

Gross Annual Rents Times 8

Total Step 1 -

STEP 2. Wages, Salaries, Etc Paid . . . . . . . . . . .

STEP 3. Gross Receipts From Sales Made and/or Work or

Services Performed

STEP 4. Total Percentages

a. Located Everywhere

STEP 5. Average Percentage

(Divide total percentages by number of factors present)

b. Located in

c. Percentage

(b/a)

"%

%

"%

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2