Instructions For C-8000d Recapture Of Capital Acquisition Deduction - Michigan

ADVERTISEMENT

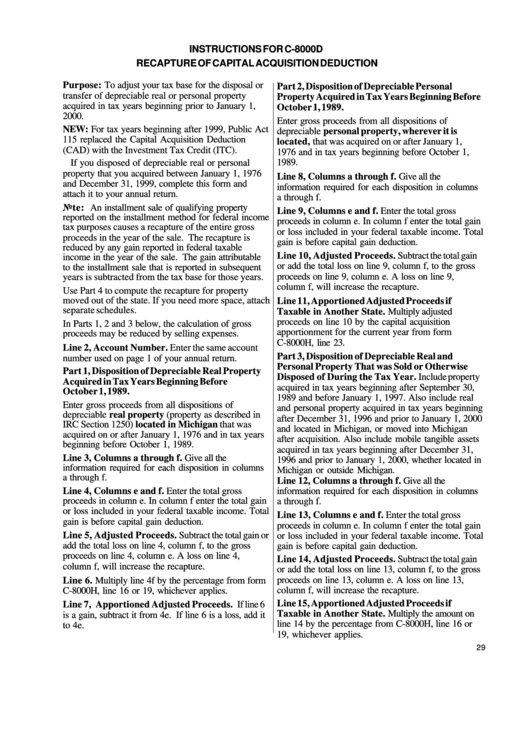

INSTRUCTIONS FOR C-8000D

RECAPTURE OF CAPITAL ACQUISITION DEDUCTION

Purpose: To adjust your tax base for the disposal or

Part 2, Disposition of Depreciable Personal

transfer of depreciable real or personal property

Property Acquired in Tax Years Beginning Before

acquired in tax years beginning prior to January 1,

October 1, 1989.

2000.

Enter gross proceeds from all dispositions of

NEW: For tax years beginning after 1999, Public Act

depreciable personal property, wherever it is

115 replaced the Capital Acquisition Deduction

located, that was acquired on or after January 1,

(CAD) with the Investment Tax Credit (ITC).

1976 and in tax years beginning before October 1,

1989.

If you disposed of depreciable real or personal

property that you acquired between January 1, 1976

Line 8, Columns a through f. Give all the

and December 31, 1999, complete this form and

information required for each disposition in columns

attach it to your annual return.

a through f.

Note: An installment sale of qualifying property

Line 9, Columns e and f. Enter the total gross

reported on the installment method for federal income

proceeds in column e. In column f enter the total gain

tax purposes causes a recapture of the entire gross

or loss included in your federal taxable income. Total

proceeds in the year of the sale. The recapture is

gain is before capital gain deduction.

reduced by any gain reported in federal taxable

Line 10, Adjusted Proceeds. Subtract the total gain

income in the year of the sale. The gain attributable

or add the total loss on line 9, column f, to the gross

to the installment sale that is reported in subsequent

proceeds on line 9, column e. A loss on line 9,

years is subtracted from the tax base for those years.

column f, will increase the recapture.

Use Part 4 to compute the recapture for property

moved out of the state. If you need more space, attach

Line 11, Apportioned Adjusted Proceeds if

separate schedules.

Taxable in Another State. Multiply adjusted

proceeds on line 10 by the capital acquisition

In Parts 1, 2 and 3 below, the calculation of gross

apportionment for the current year from form

proceeds may be reduced by selling expenses.

C-8000H, line 23.

Line 2, Account Number. Enter the same account

Part 3, Disposition of Depreciable Real and

number used on page 1 of your annual return.

Personal Property That was Sold or Otherwise

Part 1, Disposition of Depreciable Real Property

Disposed of During the Tax Year. Include property

Acquired in Tax Years Beginning Before

acquired in tax years beginning after September 30,

October 1, 1989.

1989 and before January 1, 1997. Also include real

Enter gross proceeds from all dispositions of

and personal property acquired in tax years beginning

depreciable real property (property as described in

after December 31, 1996 and prior to January 1, 2000

IRC Section 1250) located in Michigan that was

and located in Michigan, or moved into Michigan

acquired on or after January 1, 1976 and in tax years

after acquisition. Also include mobile tangible assets

beginning before October 1, 1989.

acquired in tax years beginning after December 31,

Line 3, Columns a through f. Give all the

1996 and prior to January 1, 2000, whether located in

information required for each disposition in columns

Michigan or outside Michigan.

a through f.

Line 12, Columns a through f. Give all the

Line 4, Columns e and f. Enter the total gross

information required for each disposition in columns

proceeds in column e. In column f enter the total gain

a through f.

or loss included in your federal taxable income. Total

Line 13, Columns e and f. Enter the total gross

gain is before capital gain deduction.

proceeds in column e. In column f enter the total gain

Line 5, Adjusted Proceeds. Subtract the total gain or

or loss included in your federal taxable income. Total

add the total loss on line 4, column f, to the gross

gain is before capital gain deduction.

proceeds on line 4, column e. A loss on line 4,

Line 14, Adjusted Proceeds. Subtract the total gain

column f, will increase the recapture.

or add the total loss on line 13, column f, to the gross

proceeds on line 13, column e. A loss on line 13,

Line 6. Multiply line 4f by the percentage from form

column f, will increase the recapture.

C-8000H, line 16 or 19, whichever applies.

Line 15, Apportioned Adjusted Proceeds if

Line 7, Apportioned Adjusted Proceeds. If line 6

Taxable in Another State. Multiply the amount on

is a gain, subtract it from 4e. If line 6 is a loss, add it

line 14 by the percentage from C-8000H, line 16 or

to 4e.

19, whichever applies.

29

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2