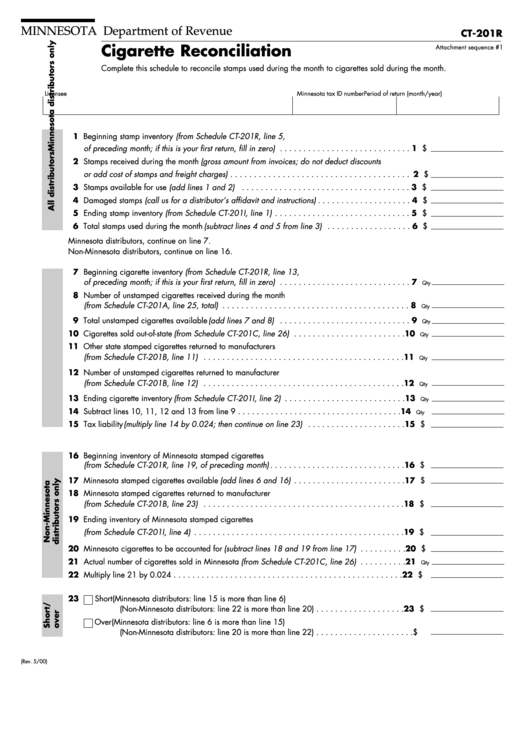

Form Ct-201r - Cigarette Reconciliation - State Of Minnesota

ADVERTISEMENT

MINNESOTA Department of Revenue

CT-201R

Cigarette Reconciliation

Attachment sequence #1

Complete this schedule to reconcile stamps used during the month to cigarettes sold during the month.

Licensee

Minnesota tax ID number

Period of return (month/year)

1 Beginning stamp inventory (from Schedule CT-201R, line 5,

of preceding month; if this is your first return, fill in zero) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 $

2 Stamps received during the month (gross amount from invoices; do not deduct discounts

or add cost of stamps and freight charges) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 $

3 Stamps available for use (add lines 1 and 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 $

4 Damaged stamps (call us for a distributor’s affidavit and instructions) . . . . . . . . . . . . . . . . . . . . 4 $

5 Ending stamp inventory (from Schedule CT-201I, line 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 $

6 Total stamps used during the month (subtract lines 4 and 5 from line 3) . . . . . . . . . . . . . . . . . . 6 $

Minnesota distributors, continue on line 7.

Non-Minnesota distributors, continue on line 16.

7 Beginning cigarette inventory (from Schedule CT-201R, line 13,

of preceding month; if this is your first return, fill in zero) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Qty

8 Number of unstamped cigarettes received during the month

(from Schedule CT-201A, line 25, total) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Qty

9 Total unstamped cigarettes available (add lines 7 and 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Qty

10 Cigarettes sold out-of-state (from Schedule CT-201C, line 26) . . . . . . . . . . . . . . . . . . . . . . . . 10

Qty

11 Other state stamped cigarettes returned to manufacturers

(from Schedule CT-201B, line 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Qty

12 Number of unstamped cigarettes returned to manufacturer

(from Schedule CT-201B, line 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

Qty

13 Ending cigarette inventory (from Schedule CT-201I, line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Qty

14 Subtract lines 10, 11, 12 and 13 from line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

Qty

15 Tax liability (multiply line 14 by 0.024; then continue on line 23) . . . . . . . . . . . . . . . . . . . . . 15 $

16 Beginning inventory of Minnesota stamped cigarettes

(from Schedule CT-201R, line 19, of preceding month) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 $

17 Minnesota stamped cigarettes available (add lines 6 and 16) . . . . . . . . . . . . . . . . . . . . . . . . 17 $

18 Minnesota stamped cigarettes returned to manufacturer

(from Schedule CT-201B, line 23) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18 $

19 Ending inventory of Minnesota stamped cigarettes

(from Schedule CT-201I, line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19 $

20 Minnesota cigarettes to be accounted for (subtract lines 18 and 19 from line 17) . . . . . . . . . . 20 $

21 Actual number of cigarettes sold in Minnesota (from Schedule CT-201C, line 26) . . . . . . . . . . 21

Qty

22 Multiply line 21 by 0.024 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22 $

23

Short (Minnesota distributors: line 15 is more than line 6)

(Non-Minnesota distributors: line 22 is more than line 20) . . . . . . . . . . . . . . . . . . . 23 $

Over

(Minnesota distributors: line 6 is more than line 15)

(Non-Minnesota distributors: line 20 is more than line 22) . . . . . . . . . . . . . . . . . . . . .

$

(Rev. 5/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1