Clear form

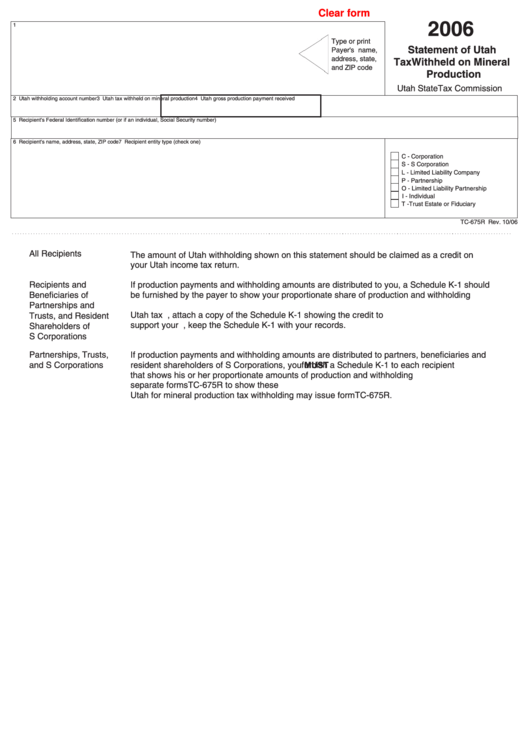

2006

1

Type or print

Statement of Utah

Payer's name,

address, state,

Tax Withheld on Mineral

and ZIP code

Production

Utah State Tax Commission

2 Utah withholding account number

3 Utah tax withheld on mineral production

4 Utah gross production payment received

5 Recipient's Federal Identification number (or if an individual, Social Security number)

6 Recipient's name, address, state, ZIP code

7 Recipient entity type (check one)

C - Corporation

S - S Corporation

L - Limited Liability Company

P - Partnership

O - Limited Liability Partnership

I - Individual

T - Trust Estate or Fiduciary

TC-675R Rev. 10/06

All Recipients

The amount of Utah withholding shown on this statement should be claimed as a credit on

your Utah income tax return.

Recipients and

If production payments and withholding amounts are distributed to you, a Schedule K-1 should

Beneficiaries of

be furnished by the payer to show your proportionate share of production and withholding

payments. The proportioned withholding amount is the amount of credit to be claimed on the

Partnerships and

Utah tax return. If filing a paper return, attach a copy of the Schedule K-1 showing the credit to

Trusts, and Resident

support your claim. If filing electronically, keep the Schedule K-1 with your records.

Shareholders of

S Corporations

Partnerships, Trusts,

If production payments and withholding amounts are distributed to partners, beneficiaries and

and S Corporations

resident shareholders of S Corporations, you

MUST

furnish a Schedule K-1 to each recipient

that shows his or her proportionate amounts of production and withholding tax. Do not issue

separate forms TC-675R to show these amounts. Only producers licensed with the State of

Utah for mineral production tax withholding may issue form TC-675R.

1

1