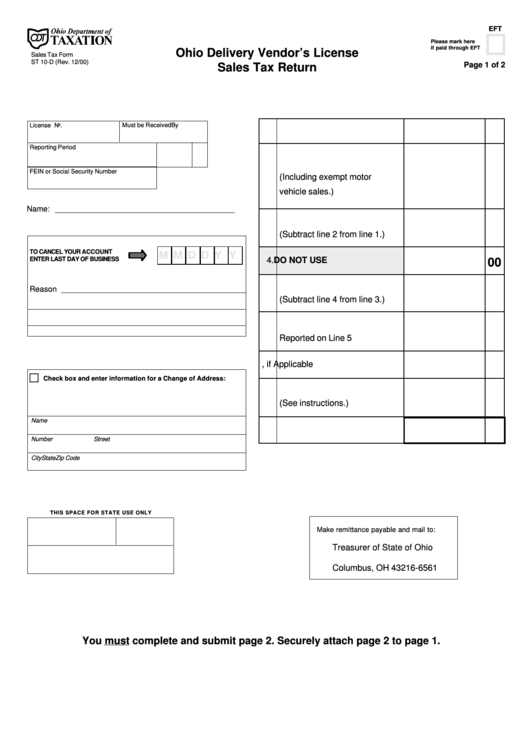

Sales Tax Form St 10-D - Ohio Delivery Vendor'S License Sales Tax Return

ADVERTISEMENT

EFT

Please mark here

if paid through EFT

Ohio Delivery Vendor’s License

Sales Tax Form

ST 10-D (Rev. 12/00)

Page 1 of 2

Sales Tax Return

License No.

Must be Received By

1. Gross Sales

Reporting Period

2. Exempt Sales

FEIN or Social Security Number

(Including exempt motor

vehicle sales.)

Name: _________________________________________

3. Net Taxable Sales

(Subtract line 2 from line 1.)

TO CANCEL YOUR ACCOUNT

M M D D Y Y

ENTER LAST DAY OF BUSINESS

4. DO NOT USE

00

5. Reportable Taxable Sales

Reason

(Subtract line 4 from line 3.)

6. Tax Liability on Sales

Reported on Line 5

7. Discount, if Applicable

c

Check box and enter information for a Change of Address:

8. Plus Additional Charge

(See instructions.)

Name

9. Net Amount Due

Number

Street

City

State

Zip Code

THIS SPACE FOR STATE USE ONLY

Make remittance payable and mail to:

Treasurer of State of Ohio

P.O. Box 16561

Columbus, OH 43216-6561

You must complete and submit page 2. Securely attach page 2 to page 1.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2