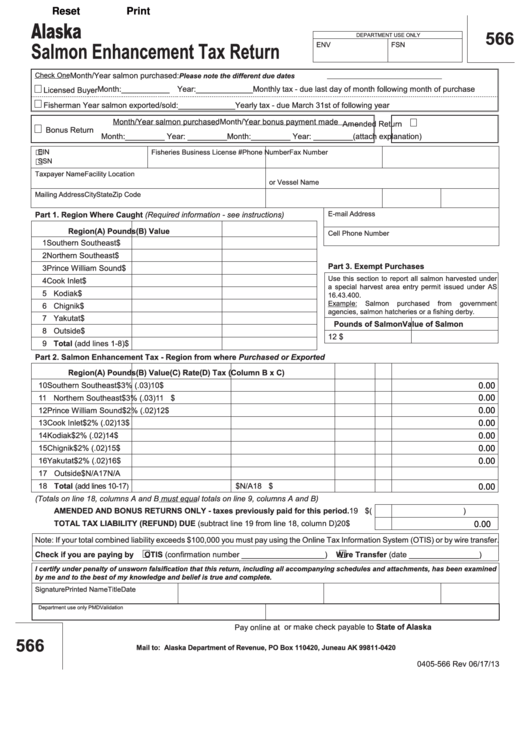

Reset

Print

Alaska

566

DEPARTMENT USE ONLY

Salmon Enhancement Tax Return

ENV

FSN

Check One

Month/Year salmon purchased:

Please note the different due dates

Licensed Buyer Month:___________ Year:_____________

Monthly tax - due last day of month following month of purchase

Fisherman

Year salmon exported/sold:_____________

Yearly tax - due March 31st of following year

Month/Year salmon purchased

Month/Year bonus payment made

Amended Return

Bonus Return

Month:_________ Year: _________

Month:_________ Year: _________

(attach explanation)

EIN

Fisheries Business License #

Phone Number

Fax Number

SSN

Taxpayer Name

Facility Location

or Vessel Name

Mailing Address

City

State

Zip Code

E-mail Address

Part 1. Region Where Caught (Required information - see instructions)

Region

(A) Pounds

(B) Value

Cell Phone Number

1 Southern Southeast

$

2 Northern Southeast

$

Part 3. Exempt Purchases

3 Prince William Sound

$

Use this section to report all salmon harvested under

4 Cook Inlet

$

a special harvest area entry permit issued under AS

5 Kodiak

$

16.43.400.

Example:

Salmon

purchased

from

government

6 Chignik

$

agencies, salmon hatcheries or a fishing derby.

7 Yakutat

$

Pounds of Salmon

Value of Salmon

8 Outside

$

1

2 $

9 Total (add lines 1-8)

$

Part 2. Salmon Enhancement Tax - Region from where Purchased or Exported

Region

(A) Pounds

(B) Value

(C) Rate

(D) Tax (Column B x C)

10 Southern Southeast

$

3% (.03)

10 $

0.00

11 Northern Southeast

$

3% (.03)

11 $

0.00

12 Prince William Sound

$

2% (.02)

12 $

0.00

13 Cook Inlet

$

2% (.02)

13 $

0.00

14 Kodiak

$

2% (.02)

14 $

0.00

15 Chignik

$

2% (.02)

15 $

0.00

16 Yakutat

$

2% (.02)

16 $

0.00

17 Outside

$

N/A

17

N/A

18 Total (add lines 10-17

$

N/A

18 $

)

0.00

(Totals on line 18, columns A and B must equal totals on line 9, columns A and B)

AMENDED AND BONUS RETURNS ONLY - taxes previously paid for this period.

19 $(

)

TOTAL TAX LIABILITY (REFUND) DUE (subtract line 19 from line 18, column D)

20 $

0.00

Note: If your total combined liability exceeds $100,000 you must pay using the Online Tax Information System (OTIS) or by wire transfer.

Check if you are paying by

OTIS (confirmation number ___________________)

Wire Transfer (date ________________)

I certify under penalty of unsworn falsification that this return, including all accompanying schedules and attachments, has been examined

by me and to the best of my knowledge and belief is true and complete.

Signature

Printed Name

Title

Date

Department use only PMD

Validation

Pay online at or make check payable to State of Alaska

566

Mail to: Alaska Department of Revenue, PO Box 110420, Juneau AK 99811-0420

0405-566 Rev 06/17/13

1

1