Form Cit-1 - New Mexico Corporate Income And Franchise Tax Return - 2009

ADVERTISEMENT

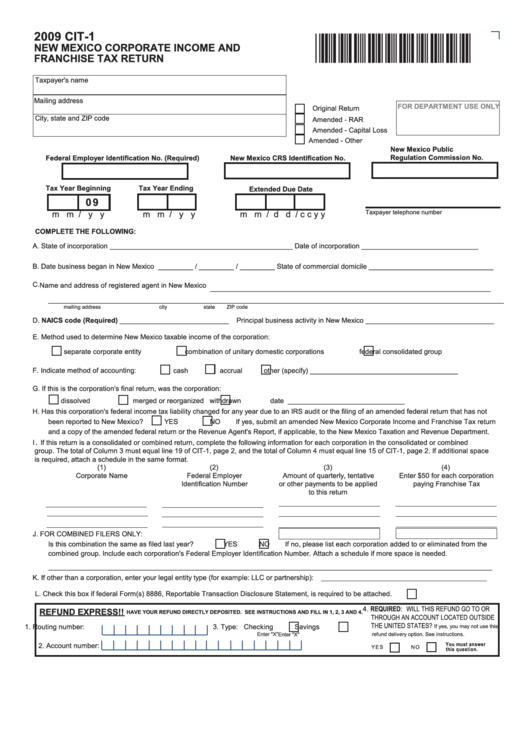

2009 CIT-1

*96080200*

NEW MEXICO CORPORATE INCOME AND

FRANCHISE TAX RETURN

Taxpayer's name

Mailing address

FOR DEPARTMENT USE ONLY

Original Return

City, state and ZIP code

Amended - RAR

Amended - Capital Loss

Amended - Other

New Mexico Public

Regulation Commission No.

Federal Employer Identification No. (Required)

New Mexico CRS Identification No.

Tax Year Beginning

Tax Year Ending

Extended Due Date

0 9

Taxpayer telephone number

m m / y y

m m / y y

m m / d d / c c y y

COMPLETE THE FOLLOWING:

A.

State of incorporation _______________________________________________ Date of incorporation ______________________________

B.

Date business began in New Mexico _________ / _________ / _________ State of commercial domicile ________________________________

C.

Name and address of registered agent in New Mexico ________________________________________________________________________

_____________________________________________________________________________________________________________________

mailing address

city

state

ZIP code

D.

NAICS code (Required) ____________________________

Principal business activity in New Mexico _________________________________

E.

Method used to determine New Mexico taxable income of the corporation:

separate corporate entity

combination of unitary domestic corporations

federal consolidated group

F.

Indicate method of accounting:

cash

accrual

other (specify) ______________________________________

G.

If this is the corporation's final return, was the corporation:

dissolved

merged or reorganized

withdrawn

date ______________________________

H.

Has this corporation's federal income tax liability changed for any year due to an IRS audit or the filing of an amended federal return that has not

been reported to New Mexico?

YES

NO

If yes, submit an amended New Mexico Corporate Income and Franchise Tax return

and a copy of the amended federal return or the Revenue Agent's Report, if applicable, to the New Mexico Taxation and Revenue Department.

I.

If this return is a consolidated or combined return, complete the following information for each corporation in the consolidated or combined

group. The total of Column 3 must equal line 19 of CIT-1, page 2, and the total of Column 4 must equal line 15 of CIT-1, page 2. If additional space

is required, attach a schedule in the same format.

(1)

(2)

(3)

(4)

Corporate Name

Federal Employer

Amount of quarterly, tentative

Enter $50 for each corporation

Identification Number

or other payments to be applied

paying Franchise Tax

to this return

J.

FOR COMBINED FILERS ONLY:

Is this combination the same as filed last year?

YES

NO

If no, please list each corporation added to or eliminated from the

combined group. Include each corporation's Federal Employer Identification Number. Attach a schedule if more space is needed.

__________________________________________________________________________________________________________________

K.

If other than a corporation, enter your legal entity type (for example: LLC or partnership):

L.

Check this box if federal Form(s) 8886, Reportable Transaction Disclosure Statement, is required to be attached.

4. REQUIRED: WILL THIS REFUND GO TO OR

REFUND EXPRESS!!

HAvE YOUR REFUND DIRECTLY DEPOSITED. SEE INSTRUCTIONS AND FILL IN 1, 2, 3 AND 4.

THROUGH AN ACCOUNT LOCATED OUTSIDE

THE UNITED STATES?

1. Routing number:

3. Type: Checking

Savings

If yes, you may not use this

Enter "X"

Enter "X"

refund delivery option. See instructions.

You must answer

2. Account number:

Y E S

N O

this question.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2