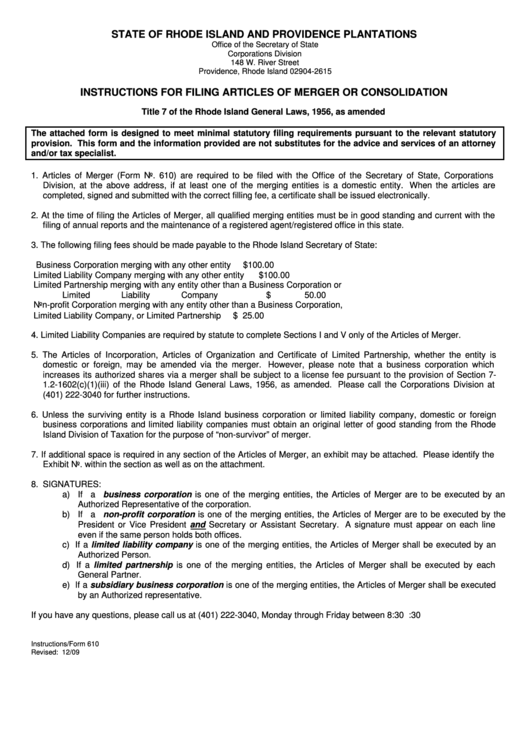

STATE OF RHODE ISLAND AND PROVIDENCE PLANTATIONS

Office of the Secretary of State

Corporations Division

148 W. River Street

Providence, Rhode Island 02904-2615

INSTRUCTIONS FOR FILING ARTICLES OF MERGER OR CONSOLIDATION

Title 7 of the Rhode Island General Laws, 1956, as amended

The attached form is designed to meet minimal statutory filing requirements pursuant to the relevant statutory

provision. This form and the information provided are not substitutes for the advice and services of an attorney

and/or tax specialist.

1. Articles of Merger (Form No. 610) are required to be filed with the Office of the Secretary of State, Corporations

Division, at the above address, if at least one of the merging entities is a domestic entity. When the articles are

completed, signed and submitted with the correct filling fee, a certificate shall be issued electronically.

2. At the time of filing the Articles of Merger, all qualified merging entities must be in good standing and current with the

filing of annual reports and the maintenance of a registered agent/registered office in this state.

3. The following filing fees should be made payable to the Rhode Island Secretary of State:

Business Corporation merging with any other entity

$100.00

Limited Liability Company merging with any other entity

$100.00

Limited Partnership merging with any entity other than a Business Corporation or

Limited Liability Company

$ 50.00

Non-profit Corporation merging with any entity other than a Business Corporation,

Limited Liability Company, or Limited Partnership

$ 25.00

4. Limited Liability Companies are required by statute to complete Sections I and V only of the Articles of Merger.

5. The Articles of Incorporation, Articles of Organization and Certificate of Limited Partnership, whether the entity is

domestic or foreign, may be amended via the merger. However, please note that a business corporation which

increases its authorized shares via a merger shall be subject to a license fee pursuant to the provision of Section 7-

1.2-1602(c)(1)(iii) of the Rhode Island General Laws, 1956, as amended. Please call the Corporations Division at

(401) 222-3040 for further instructions.

6. Unless the surviving entity is a Rhode Island business corporation or limited liability company, domestic or foreign

business corporations and limited liability companies must obtain an original letter of good standing from the Rhode

Island Division of Taxation for the purpose of “non-survivor” of merger.

7. If additional space is required in any section of the Articles of Merger, an exhibit may be attached. Please identify the

Exhibit No. within the section as well as on the attachment.

8. SIGNATURES:

a) If a business corporation is one of the merging entities, the Articles of Merger are to be executed by an

Authorized Representative of the corporation.

b) If a non-profit corporation is one of the merging entities, the Articles of Merger are to be executed by the

President or Vice President and Secretary or Assistant Secretary. A signature must appear on each line

even if the same person holds both offices.

c) If a limited liability company is one of the merging entities, the Articles of Merger shall be executed by an

Authorized Person.

d) If a limited partnership is one of the merging entities, the Articles of Merger shall be executed by each

General Partner.

e) If a subsidiary business corporation is one of the merging entities, the Articles of Merger shall be executed

by an Authorized representative.

If you have any questions, please call us at (401) 222-3040, Monday through Friday between 8:30 a.m. and 4:30 p.m.

Instructions/Form 610

Revised: 12/09

1

1 2

2 3

3