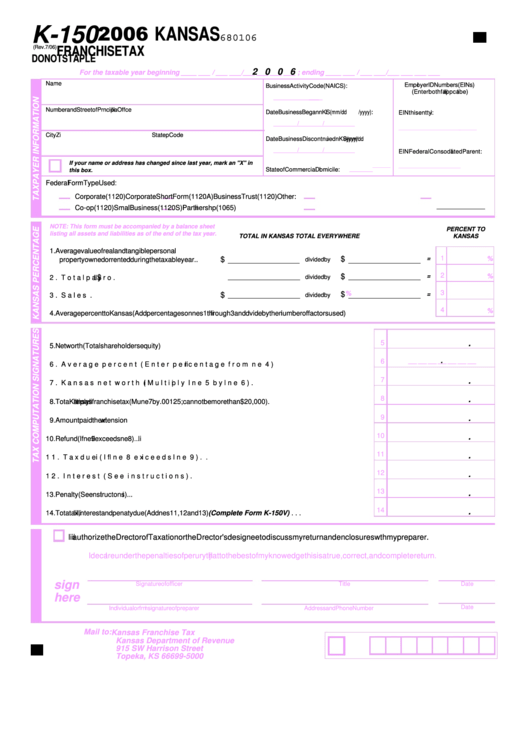

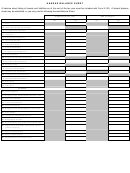

Form K-150 - Kansas Franchise Tax - Balance Sheet July 2006

ADVERTISEMENT

2006 KANSAS

K-150

680106

(Rev. 7/06)

FRANCHISE TAX

DO NOT STAPLE

2 0 0 6

For the taxable year beginning ____ ___ / ___ ___/___ ___ ___ ___ ; ending ____ ___ / ___ ___/___ ___ ___ ___

Name

Emp oyer ID Numbers (EINs)

l

Business Activity Code (NAICS):

(Enter both f app cab e)

i

li

l

___ ___ ___

___

___ ___

Number and Street of Pr ncipa Off ce

i

l

i

Date Business Began n KS (mm/dd

i

/yyyy):

EIN this ent ty:

i

___ ___ ___ ___ ___ ___ ___ ___

/

/

___ ___ ___ ___ ___ ___

___ ___

___

City

State

Zi

p Code

Date Business Discont nued n KS (mm/dd

i

i

/yyyy):

___ ___ ___ ___ ___ ___ ___ ___

/

/

EIN Federal Conso dated Parent:

li

If your name or address has changed since last year, mark an "X" in

___ ___ ___ ___ ___ ___

___ ___

___

___ ___

State of Commercia Domicile:

l

this box.

Federa Form Type Used:

l

Corporate (1120)

Corporate Short Form (1120A)

Business Trust (1120)

Other:

Co-op (1120)

Smal Business (1120S)

l

Partnersh p (1065)

i

NOTE: This form must be accompanied by a balance sheet

PERCENT TO

listing all assets and liabilities as of the end of the tax year.

TOTAL IN KANSAS

TOTAL EVERYWHERE

KANSAS

1. Average value of real and tangible personal

1

$

=

%

$

property owned or rented during the taxable year . .

divided by

2

%

$

=

$

2. Total payro . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

ll

divided by

3

%

$

=

$

3. Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

divided by

4

%

4. Average percent to Kansas (Add percentages on nes 1 through 3 and d vide by the number of factors used) . . . . . . . . . . .

li

i

5

.

5. Net worth (Total shareholders equity) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

6

___ ___ ___

___ ___ ___ ___

6. Average percent (Enter percentage from ne 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

li

7

.

7. Kansas net worth (Multiply l ne 5 by l ne 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

i

i

8

.

8. Tota Kansas franchise tax (Mu

l

ltiply li

ne 7 by .00125; cannot be more than $20,000) . . . . . . . . . . . . . .

9

.

9. Amount paid

wi

th extension. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

.

10. Refund (If ne 9 exceeds ne 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

li

li

11

.

11. Tax due (If l ne 8 exceeds l ne 9). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

i

i

12

.

12. Interest (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

.

13. Penalty (See nstruct ons) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

i

i

14

.

14. Tota tax, nterest and pena ty due (Add nes 11, 12 and 13) (Complete Form K-150V) . . . . . . . . . . .

l

i

l

li

I

authorize the D rector of Taxation or the D rector's designee to discuss my return and enclosures w th my preparer.

i

i

i

I dec are under the penalties of per ury that to the best of my know edge this is a true, correct, and complete return.

l

j

l

sign

Si

gnature of officer

Tit

le

Date

here

Date

Individual or f rm signature of preparer

i

Address and Phone Number

Mail to: Kansas Franchise Tax

Kansas Department of Revenue

915 SW Harrison Street

Topeka, KS 66699-5000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2