Form Ct - Corporation License Tax Payment

ADVERTISEMENT

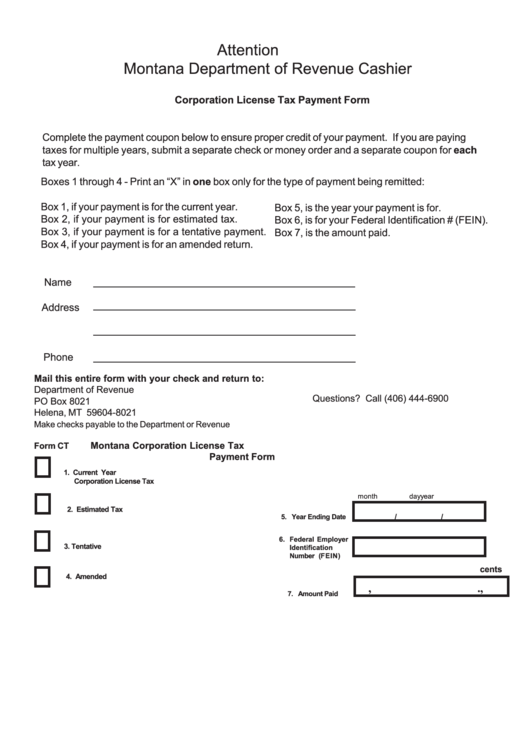

Attention

Montana Department of Revenue Cashier

Corporation License Tax Payment Form

Complete the payment coupon below to ensure proper credit of your payment. If you are paying

taxes for multiple years, submit a separate check or money order and a separate coupon for each

tax year.

Boxes 1 through 4 - Print an “X” in one box only for the type of payment being remitted:

Box 1, if your payment is for the current year.

Box 5, is the year your payment is for.

Box 2, if your payment is for estimated tax.

Box 6, is for your Federal Identification # (FEIN).

Box 3, if your payment is for a tentative payment.

Box 7, is the amount paid.

Box 4, if your payment is for an amended return.

Name

Address

Phone

Mail this entire form with your check and return to:

Department of Revenue

Questions? Call (406) 444-6900

PO Box 8021

Helena, MT 59604-8021

Make checks payable to the Department or Revenue

Montana Corporation License Tax

Form CT

Payment Form

1. Current Year

Corporation License Tax

month

day

year

2. Estimated Tax

5. Year Ending Date

/

/

Federal Employer

6.

3. Tentative

Identification

Number (FEIN)

cents

4. Amended

,

,

.

7. Amount Paid

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1