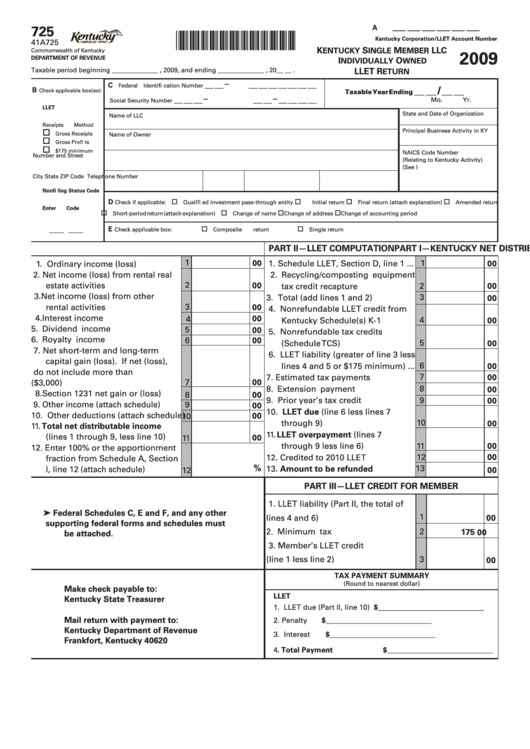

Form 725 - Kentucky Single Member Llc Individually Owned Llet Return - 2009

ADVERTISEMENT

__ __ __ __ __ __

A

725

*0900010270*

Kentucky Corporation/LLET Account Number

41A725

K

S

M

LLC

ENTUCKY

INGLE

EMBER

Commonwealth of Kentucky

2009

DEPARTMENT OF REVENUE

I

O

NDIVIDUALLY

WNED

Taxable period beginning ______________ , 2009, and ending ______________ , 20__ __ .

LLET R

ETURN

__ __ – __ __ __ __ __ __ __

C

Federal Identifi cation Number

__ __ / __ __

B

Check applicable box(es):

Taxable Year Ending

__ __ __ – __ __ – __ __ __ __

Mo.

Yr.

Social Security Number

LLET

State and Date of Organization

Name of LLC

Receipts Method

Principal Business Activity in KY

Gross Receipts

Name of Owner

Gross Profi ts

$175 minimum

NAICS Code Number

Number and Street

(Relating to Kentucky Activity)

(See )

City

State

ZIP Code

Telephone Number

Nonfi ling Status Code

D

Check if applicable:

Qualifi ed investment pass-through entity

Initial return

Final return (attach explanation)

Amended return

Enter Code

Short-period return (attach explanation)

Change of name

Change of address

Change of accounting period

E

Check applicable box:

Composite return

Single return

______ ______

PART I—KENTUCKY NET DISTRIBUTABLE INCOME

PART II—LLET COMPUTATION

1

00

1

1. Schedule LLET, Section D, line 1 ...

00

1. Ordinary income (loss) ...................

2. Net income (loss) from rental real

2. Recycling/composting equipment

2

estate activities ................................

00

tax credit recapture ........................

2

00

3. Net income (loss) from other

3. Total (add lines 1 and 2) ................

3

00

3

rental activities ...............................

00

4. Nonrefundable LLET credit from

4. Interest income ..............................

4

00

Kentucky Schedule(s) K-1 ..............

4

00

5. Dividend income ............................

5

00

5. Nonrefundable tax credits

6. Royalty income ..............................

6

00

5

00

(Schedule TCS) ...............................

7. Net short-term and long-term

6. LLET liability (greater of line 3 less

capital gain (loss). If net (loss),

6

lines 4 and 5 or $175 minimum) ...

00

do not include more than

7

7. Estimated tax payments ................

00

7

00

($3,000) ...........................................

8

8. Extension payment ........................

00

8. Section 1231 net gain or (loss) ......

8

00

9. Prior year’s tax credit .....................

9

00

9. Other income (attach schedule) .......

9

00

10. LLET due (line 6 less lines 7

10. Other deductions (attach schedule)

00

10

through 9) .......................................

10

00

11. Total net distributable income

11. LLET overpayment (lines 7

(lines 1 through 9, less line 10) .....

00

11

through 9 less line 6) .....................

11

00

12. Enter 100% or the apportionment

12. Credited to 2010 LLET ....................

12

00

fraction from Schedule A, Section

%

13

I, line 12 (attach schedule) ..............

13. Amount to be refunded .................

00

12

PART III—LLET CREDIT FOR MEMBER

1. LLET liability (Part II, the total of

➤

Federal Schedules C, E and F, and any other

1

lines 4 and 6) ..................................

00

supporting federal forms and schedules must

2. Minimum tax ..................................

2

175

00

be attached.

3. Member’s LLET credit

(line 1 less line 2) ...........................

3

00

TAX PAYMENT SUMMARY

(Round to nearest dollar)

Make check payable to:

LLET

Kentucky State Treasurer

1. LLET due (Part II, line 10)

$_____________________________

Mail return with payment to:

2. Penalty

$_____________________________

Kentucky Department of Revenue

3. Interest

$_____________________________

Frankfort, Kentucky 40620

4. Total Payment

$_____________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2