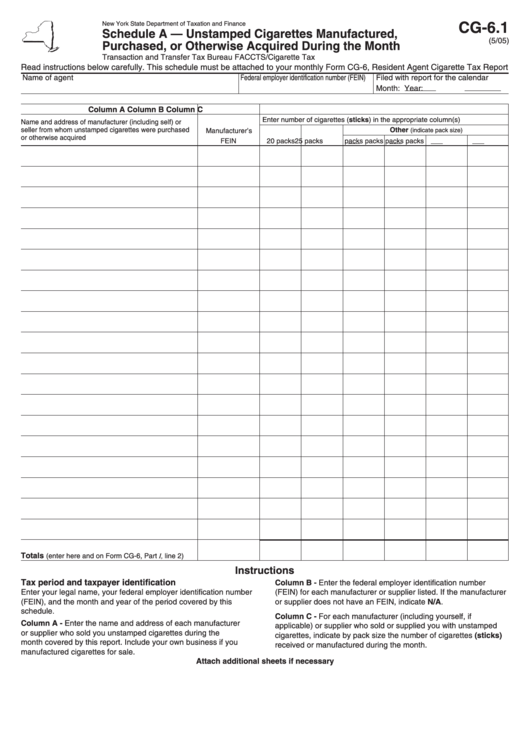

Form Cg-6.1 - Schedule A - Unstamped Cigarettes Manufactured, Purchased, Or Otherwise Acquired During The Month

ADVERTISEMENT

CG-6.1

New York State Department of Taxation and Finance

Schedule A — Unstamped Cigarettes Manufactured,

(5/05)

Purchased, or Otherwise Acquired During the Month

Transaction and Transfer Tax Bureau FACCTS/Cigarette Tax

Read instructions below carefully. This schedule must be attached to your monthly Form CG-6, Resident Agent Cigarette Tax Report

Name of agent

Federal employer identification number (FEIN)

Filed with report for the calendar

Month:

Year:

Column A

Column B

Column C

Enter number of cigarettes (sticks) in the appropriate column(s)

Name and address of manufacturer (including self) or

Other

seller from whom unstamped cigarettes were purchased

(indicate pack size)

Manufacturer’s

or otherwise acquired

FEIN

20 packs

25 packs

packs

packs

packs

packs

Totals

(enter here and on Form CG-6, Part I, line 2).....

Instructions

Tax period and taxpayer identification

Column B - Enter the federal employer identification number

Enter your legal name, your federal employer identification number

(FEIN) for each manufacturer or supplier listed. If the manufacturer

(FEIN), and the month and year of the period covered by this

or supplier does not have an FEIN, indicate N/A.

schedule.

Column C - For each manufacturer (including yourself, if

Column A - Enter the name and address of each manufacturer

applicable) or supplier who sold or supplied you with unstamped

or supplier who sold you unstamped cigarettes during the

cigarettes, indicate by pack size the number of cigarettes (sticks)

month covered by this report. Include your own business if you

received or manufactured during the month.

manufactured cigarettes for sale.

Attach additional sheets if necessary

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1